How sure are you of those numbers? I don't even see clothes for growing kids on here, or is putting clothes on your kids "entertainment". HI is probably right because you'll qualify for a subsidy, but what happens if that goes away?

Going back to December...

http://www.early-retirement.org/forums/f26/retire-early-vs-work-to-leave-for-kids-89814.html

You've gone from looking to retire with perhaps $2M and contemplating leaving the kids $1M to squashing them in the same bedroom and not doing anything but free activities (which I think are a lot rarer in schools these days). What happened in these 7 months?

My opinion? I think you're being selfish and lazy, and taking a huge risk. You don't have any buffer that I see to weather a downturn. Sure, the plan has a possibility of working, if you're lucky, and basically spend very little money to entertain you and your family.

Agreed 100%. I remembered this thread from December and likewise checked those posts (before I saw this post of yours).

Let's remember - OP is earning $280,000 a year today and yet has "only" amassed $650k (up from $550k 7 months ago).

Back in December, the "ideal" time to FIRE was in 10 to 15 years.

Being tired of working at 38 with a family of 4 and only $650k saved does not cut it in my book.

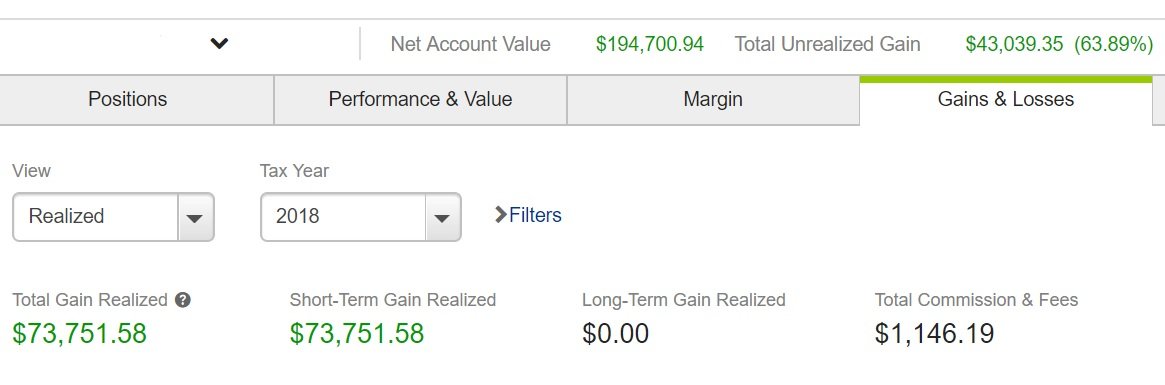

Vanguard Technology Fund (VGT): 200k

Vanguard Mega Cap Growth Fund: 50k

Amazon Stock: 50k

Google Stock: 60k

Facebook Stock: 40k

Lending Club: 50k

Talk about a risky portfolio! That $450k can fall 25% quite easily.

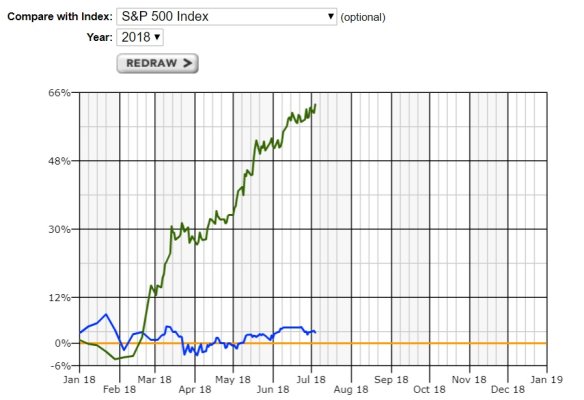

More importantly, in the 7 months, what was previously a more conservative portfolio (shown below) is now heavily technology oriented and significantly higher risk:

Investments (Vanguard total stock market index): 350K

The budget laid out is unrealistic in many ways. Most of the amounts likely need to be raised at least 50%. I see nothing for transportation - whether car/gas/insurance or public transportation. A cross country move for the family and belongings will be another $5k to $10k.

Further, making reliable Social Security calculations today to begin taking payouts in 25 years is also extremely risky.

My belief is that retiring now on the $650k will likely see it completely wiped out well before Social Security kicks in.

Take a week long vacation to recharge, pull up your big boy pants, and milk that $280k job for all it's worth, saving as much as you can for as long as you can. Stick with it another 5 years to the point where you are comfortably over $1M and then revisit. If you still feel the same, you'll be in a much better position financially.

Lastly, have you discussed any of this with your spouse/family? I have to believe they wouldn't be without a fair degree of uneasiness about your idea.