I'd betcha there weren't significant low-cost options.

Betcha you are right.

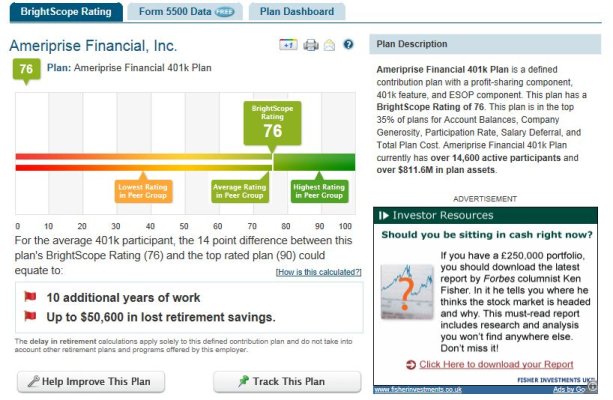

Digging a little deeper in the Brightscope report referenced by Alan:

Name of Investment ........Investment Manager ..........Dollar Value

Alliance Bernstein Int'l .....Alliance Bernstein .............$56,722,728

Rvs Trust Eq. Index Fund..Ameriprise Trust Company ...$41,591,348

Wel'ton Midcap Growth.....Wellington Trust ................$41,122,825

Rvs Trust Stable Cap I .....Ameriprise Trust Company ...$13,820,987

Rvs Us Gov't Securities I ...Ameriprise Trust Company .. $13,553,503

Wel'ton Large Cap Growth...Wellington Trust ...............$13,363,572

Rvs Trust Gov't Income Fund. Ameriprise Trust Company .$4,469,568

...........................................................................Total $184,644,531

The current 11-K form for the plan can be found here:

SEC Info - Ameriprise Financial Inc - 11-K - For 12/31/10

"

Investment Options

A summary of investment options at December 31, 2010 is set forth below:

Mutual Funds — “Columbia and RiverSource® Funds” — Columbia Diversified Bond Fund, RiverSource Balanced Fund, Columbia Retirement Plus 2010 — 2045 Funds, Columbia Mid Cap Value Fund, Columbia Diversified Equity Income Fund and Columbia Large Core Quantitative Fund — are mutual funds offered to the general public. Each of the funds is managed by Columbia Management Investment Advisers, LLC (formerly RiverSource Investments, LLC), a wholly-owned subsidiary of the Company. James Small Cap Fund is managed by James Investment Research. Alger Small Cap Growth Institutional Fund is managed by Alger Group.

Collective Investment Funds — RiverSource Trust Equity Index Fund III is a collective fund, managed by Ameriprise Trust Company. Wellington Trust Mid Cap Growth Portfolio and Wellington Trust Large Cap Growth Portfolio are managed by Wellington Management Company LLP. AllianceBernstein International Style Blend Collective Fund is managed by AllianceBernstein LP.

Ameriprise Financial Stock Fund — The Ameriprise Financial Stock Fund is an Employee Stock Ownership Plan (“ESOP”) that invests primarily in the Company’s common stock, purchased in either the open market or directly from the Company, and in cash or short-term cash equivalents.

Self-Managed Brokerage Account— The SMBA gives participants the freedom to invest in a wide variety of mutual funds in addition to the other aforementioned investment options. Participants are provided over 800 mutual funds from which to choose. American Express Company common stock is held in the SMBA on a hold or sell basis only and new purchases are not allowed.

Income Fund — Invests primarily in various book value wrap contracts, directly or indirectly, offered by insurance companies and banks, backed by fixed income securities issued by the U.S. government and its agencies. See Note 5 for a more comprehensive discussion of book value wrap contracts. Ameriprise Trust Company is the investment manager for the Income Fund. The Income Fund also invests in the RiverSource Trust U.S. Government Securities Fund I (which invests primarily in short-term debt instruments issued by the U.S. government and its agencies), the RiverSource Trust Government Income Fund (which invests primarily in U.S. Treasury, agency and mortgage backed securities) and the RiverSource Trust Stable Capital Fund I (which invests primarily in a diversified pool of U.S. Treasury, agency and mortgage backed securities together with book value wrap contracts of varying maturity, sizes and yields). The goal of these funds is to maximize current income consistent with the preservation of principal."