DEC-1982

Full time employment: Posting here.

I have not contributed to this year's Roth. May be an opportunity.

+1, zero till now.

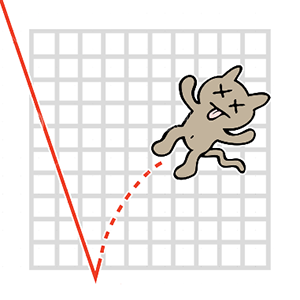

Over the weekend when I looked at the PE ratio for the S&P 500 index and Shiller PE10 index , I thought the overall market was still very overvalued, compared to historical norms. Even if the S&P 500 dropped by 50 points today it would be overvalued but by less.