Another Reader

Thinks s/he gets paid by the post

- Joined

- Jan 6, 2013

- Messages

- 3,413

I keep reserve funds at multiple banks, including Bank of America. I have a "free" checking account, something called Advantage Relationship Checking. I keep a not insubstantial amount there, for which I am paid pennies in interest. No monthly checking fee, and Preferred Rewards on the credit cards.

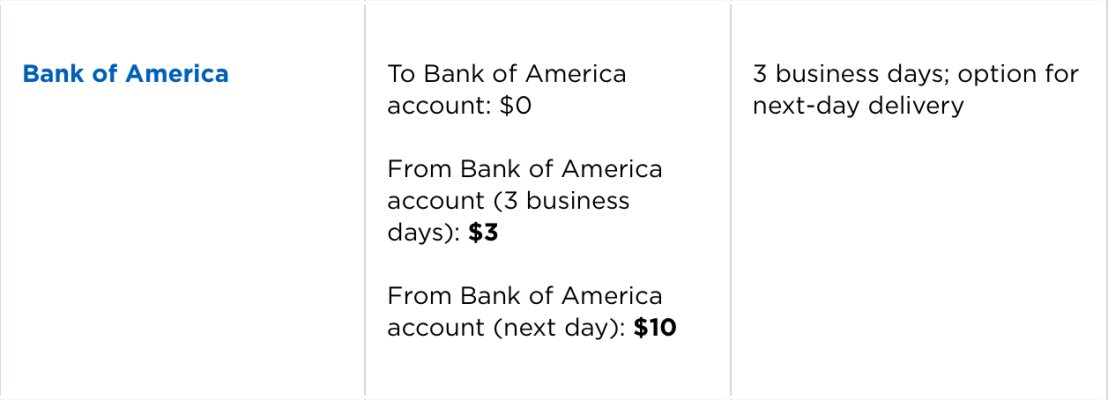

I'm doing some work on one of the rentals, and I just paid a lot in property taxes and for other projects. There is extra money sitting in B of A, so I thought I would skim a little off for the work. I go to make the transfer, and they want $3.00 to make an outgoing ACH transfer. Huh? Literally NO other bank I use charges an ACH fee.

I read all the fee disclosures for this account available on-line and NOWHERE is an ACH fee mentioned. However, I can get free checks. Surely it costs them more to process a check I write and deposit at my main bank than it costs to process an ACH transfer.

Some people go clearance sale shopping the day after Christmas. I'm going to visit my local B of A branch and make my complaint known. And probably order some free checks...

I'm doing some work on one of the rentals, and I just paid a lot in property taxes and for other projects. There is extra money sitting in B of A, so I thought I would skim a little off for the work. I go to make the transfer, and they want $3.00 to make an outgoing ACH transfer. Huh? Literally NO other bank I use charges an ACH fee.

I read all the fee disclosures for this account available on-line and NOWHERE is an ACH fee mentioned. However, I can get free checks. Surely it costs them more to process a check I write and deposit at my main bank than it costs to process an ACH transfer.

Some people go clearance sale shopping the day after Christmas. I'm going to visit my local B of A branch and make my complaint known. And probably order some free checks...