REWahoo

Give me a museum and I'll fill it. (Picasso) Give

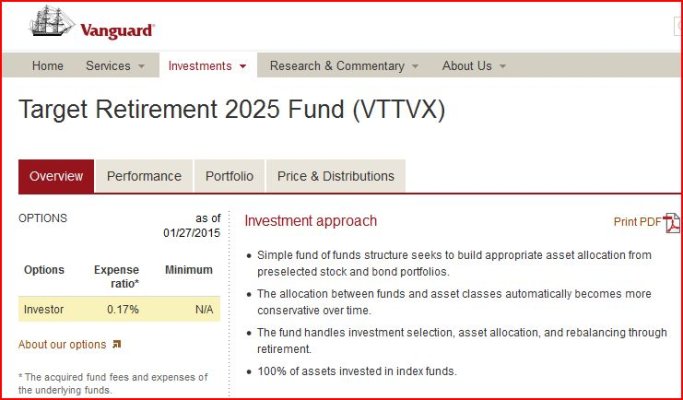

According to Paul Merriman, the answer is Vanguard. The reason is a familiar one - cost.

Best target-date funds? Fidelity vs. Vanguard - MarketWatch

Why are Fidelity expenses more than three times as high as Vanguard's for managing essentially identical portfolios? I think there are at least three important reasons.

First, Fidelity pays active fund managers to try to beat the market. These are bright, expensive employees whose compensation burdens the expense ratio of every fund except index funds. Vanguard funds have managers, of course, but their job is much simpler: To follow indexes.

Second, Fidelity must make profits for corporate shareholders. Vanguard, on the other hand, is owned by the shareholders in its funds. Operating profits go right back to those shareholders.

Third and perhaps most important, Fidelity charges higher expenses (and thus delivers lower returns) simply because it can.

Best target-date funds? Fidelity vs. Vanguard - MarketWatch