target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

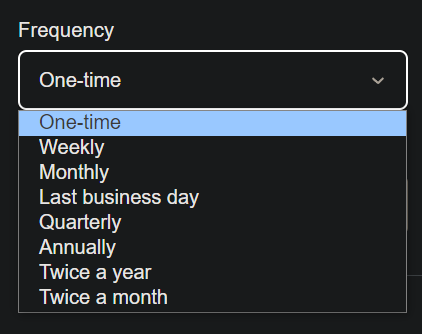

Thanks. I was thinking that was your reason. For me a week #2 check would make sense. Or maybe quarterly.Quite possibly, yes.

In my case, I have pension/annuity income hitting my checking account on the first, so I stagger my RMD income by a couple weeks.

YMMV, as someone once said...