lawman

Thinks s/he gets paid by the post

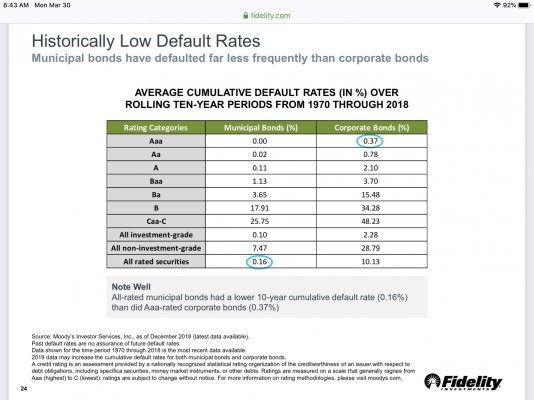

I have started buying some investment grade short term corporate bonds. I know nothing about some of the offerings other than what is shown on the offerings page of Schwab..How much risk am I assuming on 3 yr offerings that are rated at least BBB or higher?

Also some have transaction fees...Is that normal?

Also some have transaction fees...Is that normal?