jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I haven't seen this posted. Mods feel free to delete if this is a duplicate.

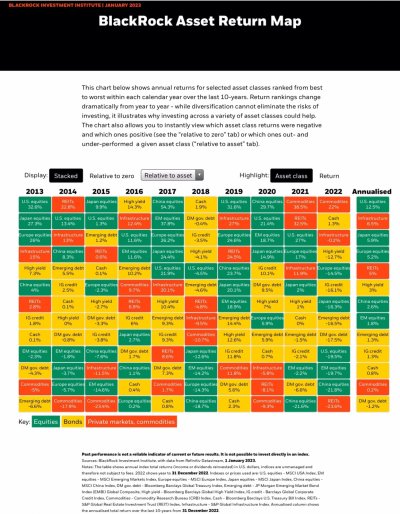

The Callan Periodic Table of Investment Returns shows annual investment returns by asset class. It is generally used to demonstrate the value of diversification. In case anyone was asleep at the wheel, it was a rough year.

The Callan Periodic Table of Investment Returns shows annual investment returns by asset class. It is generally used to demonstrate the value of diversification. In case anyone was asleep at the wheel, it was a rough year.