You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cashed out Son’s 529

- Thread starter BobMW

- Start date

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There is no withholding on distributions from 529s, whether Vanguard or not, and whether qualified or not.

You have it almost correct. The following assumes that this distribution was the only distribution this year, and the entire amount was for nonqualified expenses:

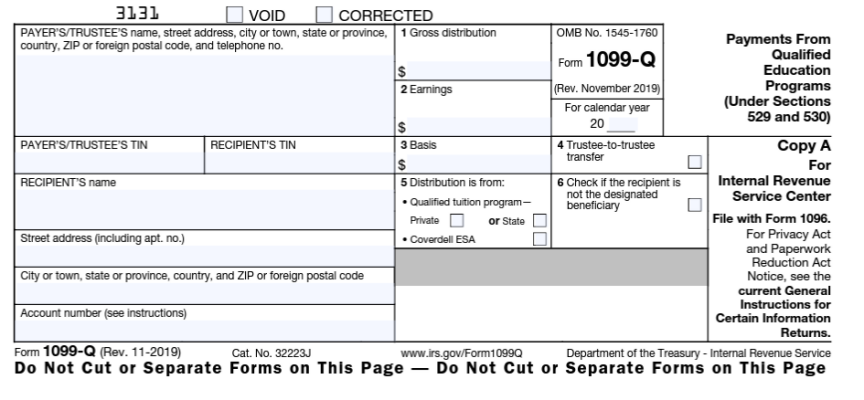

Your son will receive a 1099-Q in January. The amount distributed will be in box 1, earnings will be in box 2.

He will owe ordinary income tax on the amount in box 2.

He will also owe a 10% penalty on the amount in box 2. Although he may qualify for an exception to the 10% penalty if he received nontaxable scholarships during his college career. There are also some other exceptions to the 10% penalty.

So generally speaking, the income tax plus 10% penalty is only on the earnings, not the whole distribution.

You have it almost correct. The following assumes that this distribution was the only distribution this year, and the entire amount was for nonqualified expenses:

Your son will receive a 1099-Q in January. The amount distributed will be in box 1, earnings will be in box 2.

He will owe ordinary income tax on the amount in box 2.

He will also owe a 10% penalty on the amount in box 2. Although he may qualify for an exception to the 10% penalty if he received nontaxable scholarships during his college career. There are also some other exceptions to the 10% penalty.

So generally speaking, the income tax plus 10% penalty is only on the earnings, not the whole distribution.

So box 2 is blank, box 3 has a 11 digit # in it. No taxes owed then?

Are you sure you have a 1099-Q like this, and not some other form?

Attachments

RetiredAt55.5

Full time employment: Posting here.

FWIW, when I got my 1099-Q from Vanguard this year, it didn't separate out the qualified distributions from the non-qualified distributions, so the investment gain is too high.

The transaction history for each withdrawal does show the basis and gain whether it was a qualified withdrawal or not, so I can calculate the correct amount myself.

I seem to recall they did the same thing in a prior year when I did both types of withdrawals.

Sigh.

The transaction history for each withdrawal does show the basis and gain whether it was a qualified withdrawal or not, so I can calculate the correct amount myself.

I seem to recall they did the same thing in a prior year when I did both types of withdrawals.

Sigh.

- Joined

- Oct 13, 2010

- Messages

- 10,764

It's always up to the tax payer to determine how much of the withdrawal was for QHEE; Vanguard isn't on the hook to make that determination.

For instance, if I have a check cut to myself and I pay my kid's tuition bill, it's the same, tax-wise, as having a check cut directly to the university.

For instance, if I have a check cut to myself and I pay my kid's tuition bill, it's the same, tax-wise, as having a check cut directly to the university.

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,383

Did you get any state tax breaks when you deposited $$ into the accounts? (Mine gives me a deduction for the first $6,000 every year.) If so, the state will probably claw that back, too.

Brat

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Can you transfer the 529 to another eligible family member? Is he the owner of the account?

If it can be transferred perhaps you could loan your son the money he needs for the divorce and you could preserve the gain.

If it can be transferred perhaps you could loan your son the money he needs for the divorce and you could preserve the gain.

RetiredAt55.5

Full time employment: Posting here.

It's always up to the tax payer to determine how much of the withdrawal was for QHEE; Vanguard isn't on the hook to make that determination.

For instance, if I have a check cut to myself and I pay my kid's tuition bill, it's the same, tax-wise, as having a check cut directly to the university.

When you make a withdrawal using their website, they force you to specify whether the withdrawal is qualified or non-qualified.

So while I'm not disagreeing with you, I do wonder why they bother asking.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

When you make a withdrawal using their website, they force you to specify whether the withdrawal is qualified or non-qualified.

So while I'm not disagreeing with you, I do wonder why they bother asking.

My state 529 does the same thing. You have to specify Q or NQ, but there is nothing on the 1099-Q and the TP has to figure it. Since I know how to figure it and it doesn't seem to matter, I mark all as Q and then correctly report it at tax time.

As an aside, the SSN that appears on the 1099-Q may vary depending on who the distribution is made to (school, parent, student), and this may affect on whose tax return any NQ distribution should be reported. This in turn may affect how much tax is paid on the NQ distribution.

On the phone some time with Vang to clear this up yesterday. To their credit they stayed with me, and when transfered I was picked up pretty quickly. It didn't help that this was a Coverdell and not a 529 as I originally thought - my bad. Eventually as they looked thru the account, they found the original investments for basis. What was interesting, the Vang rep then walked me thru how to find that info on the website myself very quickly. I then used the Coverdell 6-3 worksheet from IRS Pub 970 to get a reportable income figure.

- Joined

- Oct 13, 2010

- Messages

- 10,764

I'm all about being corrected if experience differs. My experience was with Fidelity, and I don't recall the form telling me the qualified amount.So while I'm not disagreeing with you, I do wonder why they bother asking.

About the SSN on the form, absolutely! If the check is to the student or the student account, it goes on their taxes. If the parent gets a check, on the parents' taxes.

Similar threads

- Replies

- 30

- Views

- 3K