HawkeyeNFO

Thinks s/he gets paid by the post

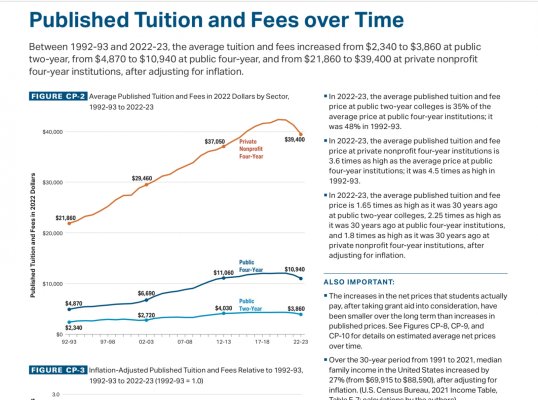

"Colleges give out so much grant aid that the advertised price of college has evolved into a largely fictional marketing tool, akin to the rack rates posted on hotel doors."

https://thehill.com/business/400259...-price-college-costs-are-actually-going-down/

https://thehill.com/business/400259...-price-college-costs-are-actually-going-down/