NotMyFault

Recycles dryer sheets

- Joined

- Jun 29, 2012

- Messages

- 91

I find that I like asparagus much more than market corrections. Especially when it is roasted with garlic.

NMF

NMF

I find that I like asparagus much more than market corrections. Especially when it is roasted with garlic.

NMF

Just try to avoid drawing in the dancing lady who likes to make happy noises....Portfolio setting new high everyday here. A pull-back may happen anytime now, but I do not think it will be a full correction, meaning a drop of 10%.

If I am wrong, don't sue me. I will gladly give back what my advice costs you: 0 cent.

Yep, equities look exactly like the Venezuelan beaver cheese futures market right before it crashed. Be afraid, very afraid.

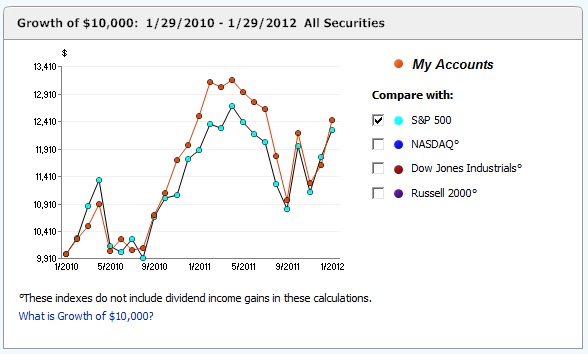

From Jan 2010 up till mid 2011, I beat the pants off the S&P, then lost that gain, and trailed the S&P for the next 12 months. Started to do well again in mid 2012 till now, but only caught up to the old high.

OK, as a picture is worth a thousand words, here's the comparison of my portfolio to the S&P 500 in the two-year period of 2010-2011.

Markets Soar But the Retail Investor Is Not Back (Yet) | Daily Ticker - Yahoo! FinanceApparently the massive inflows into equities story is not true - maybe a week made all the difference. I don't have a reference yet.

I figure some of the money in early Jan was "tax-gain" money. Instead of buying right back, investors figured prices might keep dropping as other investors did the same. Jan 1 - that game was over, so folks bought back in.Markets Soar But the Retail Investor Is Not Back (Yet) | Daily Ticker - Yahoo! Finance

"The Wall Street Journal printed the following headline on its front page Wednesday: Individual Investors Help Drive Stock Surge. The article cites a report by mutual-fund tracker Lipper Inc. showing that $6.8 billion has flowed into stock mutual funds in just the first three weeks of this year.

But as The Daily Ticker’s Aaron Task and Lauren Lyster point out in the accompanying video, reports of the retail investors' return may be exaggerated. The Lipper figure is the biggest inflow into equity mutual funds since 2001 yet it is nothing compared to the net outflows from 2009-2012. Over that three-year period, a total of $287 billion left the market. In December 2012 alone, $55 billion made its way out of the market as fears over the so-called fiscal cliff scared off investors."

Oh. I see... full disclosure, huh?

This is what our portfolio looks like over the past five years. Years in which we have done nothing other than draw about 4% out -- no AA adjustments or additional purchases, for instance.

View attachment 15937

PS. I started to use Quicken in early 2010, when MS Money went defunct. Hence, cannot easily created a chart that goes back before 2010.

Euell Gibbons...Talk about a blast from the past. I haven't heard that name in forever. I remember those commercials. I couldn't resist and googled him. Died in 1975, wow that was a long time ago. I guess no one under 30 would have got your joke. I truly am getting old.....

No, not consistently. I am certainly not that arrogant to set such aspiration. Win some, lose some.

The Lipper figure is the biggest inflow into equity mutual funds since 2001 yet it is nothing compared to the net outflows from 2009-2012. Over that three-year period, a total of $287 billion left the market. In December 2012 alone, $55 billion made its way out of the market as fears over the so-called fiscal cliff scared off investors."

Tee-hee. Hope springs eternal.Given that my investment style was more active than that of many people here, I should have done a bit better.

Anyway, when MS Money died I kept on using it. That is, I didn't even notice that it died because it still works.Anyway, when MS Money died I transferred everything into Moneydance so did not lose any data. I can go back about 20 years if I need to.