CVS, Walgreens, Target, Kohls, Sears, Carsons/Bergners, and dozens of other companies offer "specials", cash backs, coupons, gasoline credits, and "doubles" of this or that... DW, Finally!... said "this is stupid!" We don't buy very much any more, and I agree.

But obviously not, as they all seem to court their (own) customers. Do customer loyalty programs work for you?

....................................................................................................

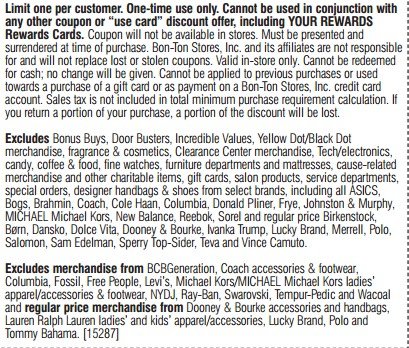

Here's a disclaimer for one of the special customer $$$ off offers.

But obviously not, as they all seem to court their (own) customers. Do customer loyalty programs work for you?

....................................................................................................

Here's a disclaimer for one of the special customer $$$ off offers.

Attachments

Last edited:

) or are good for 50 cents off of 4 of something. Not worth it.

) or are good for 50 cents off of 4 of something. Not worth it.