... I am interested to learn more about this topic from the "FX experts" here.

Well, I am no expert but in @TechLead's absence I can give you a few pointers to guide your own research:

Compared to Forex, the US stock market is a calm and predictable place.

Start with spot rates: Currencies are basically commodities in this view. If a lot of Euro-holders want to buy dollar-denominated products or assets, the value of the dollar will rise. Lately the spot dollar is down like 9% from March; people with dollars are bidding against each other to buy other currencies, driving the spot dollar rate down. IIRRC the Euro was $1.12 when we were traveling in central Europe last year. Now a Euro costs $1.18. That is a big move.

Next: PPP. Purchasing power parity. This is a different way of valuing currencies based on what they can buy. For example if I can buy a bushel of a grain for $5 in the US and that same bushel costs 10 rubles in Russia, then we would say that a dollar is worth two rubles. PPP rates can vary quite a bit from spot rates.

Next: The Big Mac Index. 35 years ago this was a tongue-in-cheek PPP exercise by The Economist magazine but is now taken somewhat seriously. Instead of looking at bushels of grain, they look at the price of a Big Mac in 30+ countries and calculate a PPP on that basis. Example If a Big Mac costs $5 in the US and 50 ringgit in Malaysia, then a ringitt is worth ten cents. (These are totally bogus numbers). There is a great discussion of "burgernomics" here:

https://www.economist.com/news/2020/07/15/the-big-mac-index

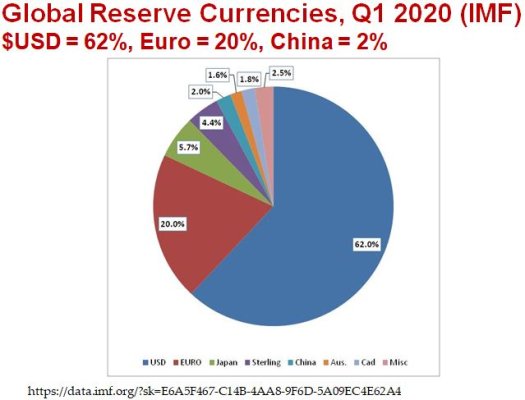

But forex is not just about buying and selling. Politics has a huge impact on values. Some countries peg their currencies to the dollar or the Euro and others actually use someone else's currency as their own, like Ecuador. Poor countries' debts are often based on dollars because buyers do not trust the debtor country's currency. Currency values affect trade, too, so often we will see "currency manipulator" governments trying to drive their currency values down in order to boost exports by making their exports cheaper. China has been the subject of heated criticism as a manipulator, though less so in recent years.

So, you can go off and start studying this stuff. Maybe take a year or two, figure it out, and come back to explain it to us.