ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It wouldn't surprise me to see the Dow at 20,000 by the end of this decade. That would equate to just under 4.5% annual return on the market. While that's by no means guaranteed in the short term, it would be far from unheard of. 20-30 years from now would indicate that the stock market underperformed inflation... not impossible, just unlikely.Originally Posted by obgyn65 View Post

My thought is that Dow at 36,000 is not likely in my lifetime. Maybe 20,000 in 20-30 years from now.

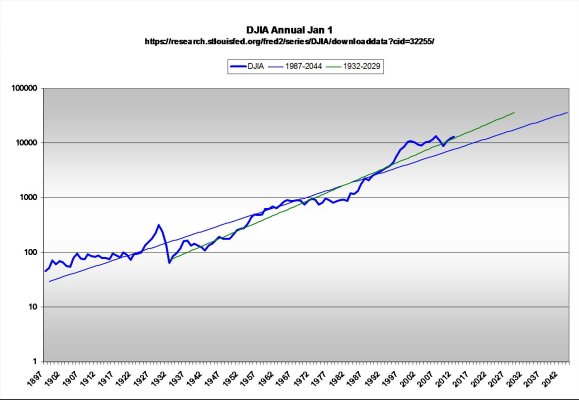

So I tried a FIRECalc run to try to get an idea on the history. I entered $1M portfolio, 100% equities, zero spend, zero fees to try to see what the market has done in 30 years. Should be close to what the DOW has done.

I had to magnify my screen, and measure from the graph, since FIRECalc has a bug - it does not really report the low of the ending portfolios if the start was lower. Interestingly though, it shows 2.35x gain in the worst case 30 year period.

2.35 x DOW 15,368 = 36,115.

So a DOW 36,000 is about the worst it has ever done. Sure, it could be worse going forward, but it seems that would be an outlier, and I sure would not bet against it and certainly not against 20,000. The average gain is closer to 7x, that would be DOW..... ready....?

107,576

-ERD50