Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,554

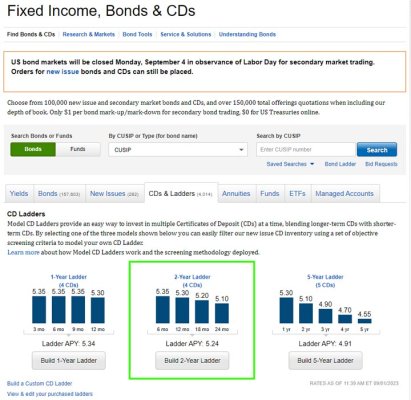

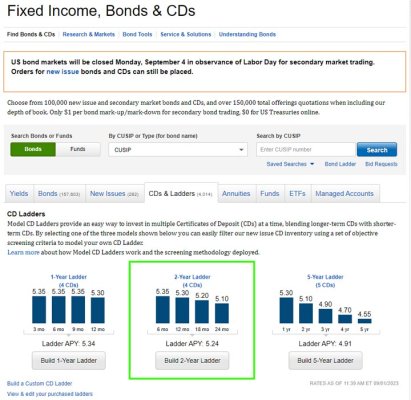

I'm transitioning to allocating more of my portfolio to fixed income. As such, I'm exploring CD ladders. I've got the bulk of my investments at Fidelity.

I've often read here about the ease of building a CD ladder at Fidelity--"just a couple of clicks, might take you two minutes" seems to be a common refrain.

Is it really that easy?

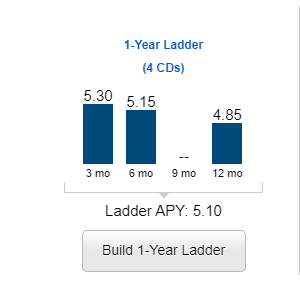

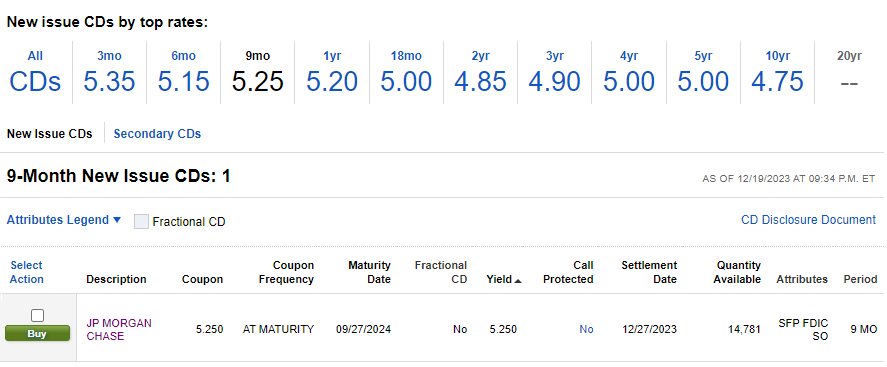

I think I found the appropriate page for building a CD ladder at Fidelity. Is it really just a matter of clicking on one of the time horizons and filling out the guided menu choices?

Is there any reason I should not select the default choices that Fidelity presents to me?

Any other hints or tips are appreciated.

I've often read here about the ease of building a CD ladder at Fidelity--"just a couple of clicks, might take you two minutes" seems to be a common refrain.

Is it really that easy?

I think I found the appropriate page for building a CD ladder at Fidelity. Is it really just a matter of clicking on one of the time horizons and filling out the guided menu choices?

Is there any reason I should not select the default choices that Fidelity presents to me?

Any other hints or tips are appreciated.