Closet_Gamer

Thinks s/he gets paid by the post

Warning:

I'm starting this thread for fun. The approaches discussed are not ideas typical investors should seriously consider let alone actually execute. This is intended for the finance geeks who like thinking about/discussing this stuff.

With that disclaimer out there...

I've made a couple of posts about the potential for substantial inflation but don't want to derail those threads with this topic.

(https://www.early-retirement.org/fo...ion-is-here-to-stay-109440-4.html#post2616686)

The constant theme, however, is that we don't really know.

So, I started thinking about exotic approaches to inflation protection. Not run of the mill asset allocation type stuff, but positions designed to deal with a severe inflation.

Crypto is often discussed as a new vehicle for hedging inflation, but I feel the sheer volatility and uncertainy would compound rather than hedge risk.

But using derivatives, maybe amped up with leverage, could create positions where you're likely to lose a relatively small amount of money but if you win, you can win big.

Rather than buying and holding assets with the intent of hedging inflation, which ties up loads of money for a long time, this could be an opportunity to use LEAP calls on ETFs that are likely to rise in the face of inflation.

Candidates

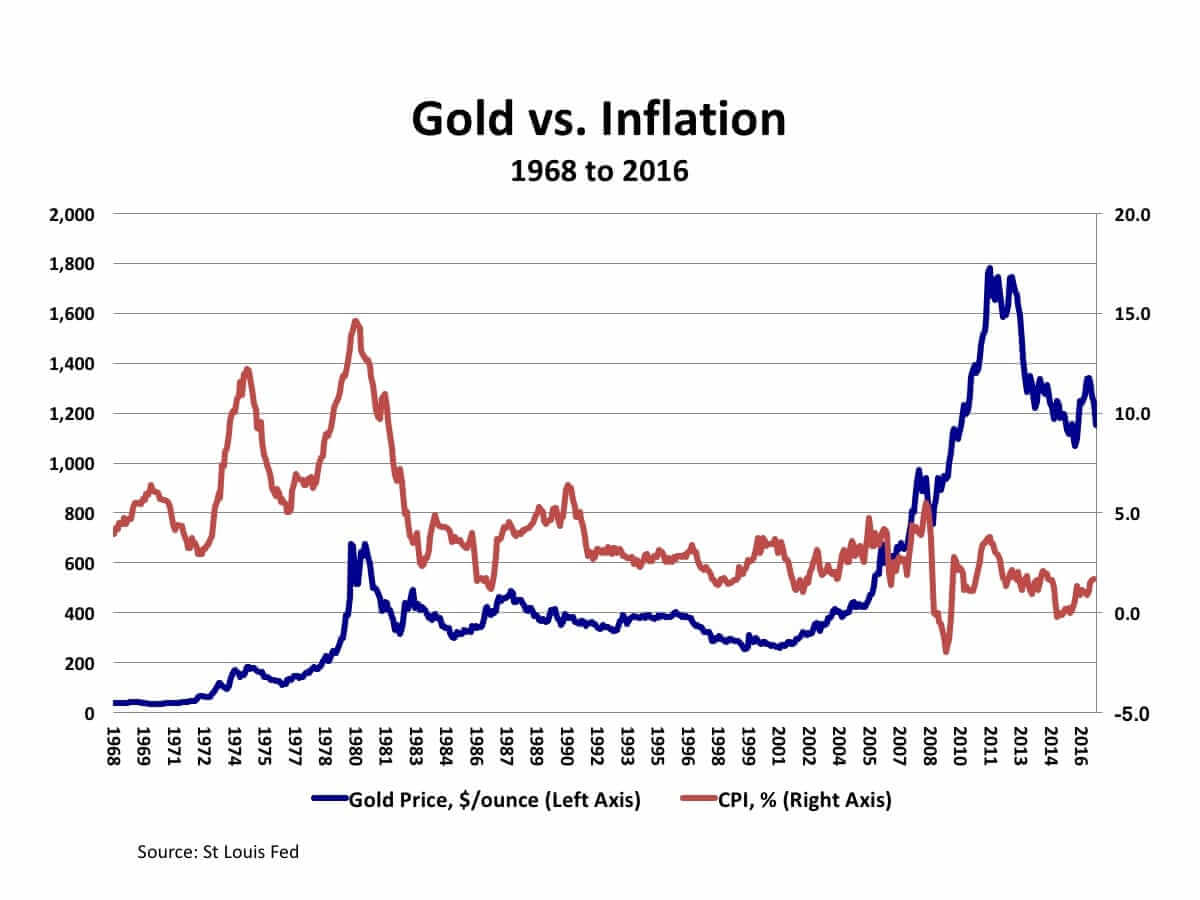

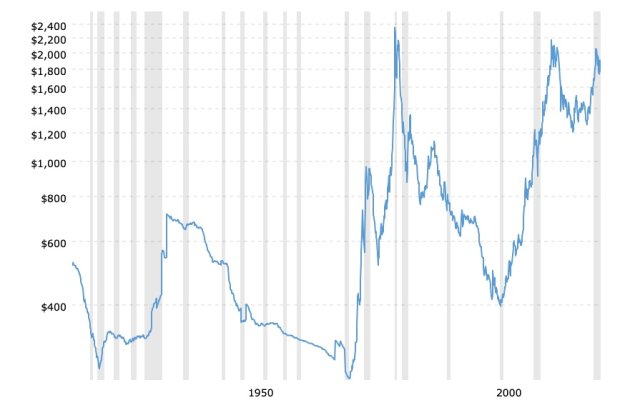

GLD (Gold)

XLRE (Real Estate)

VXUS (International)

VWO (emerging markets)

TIP (TIPS bonds)

You might also go for LEAP puts on long duration bond ETFs.

If you wanted to really go for it, perhaps a Pledged Asset Line or HELOC would be a vehicle to fund this. A 2-3% APR loan would allow you to tie up very little money at low carrying cost that could be used to buy the derivatives. Of course the hurdle rate for success goes up, but you would be buying things that are well out of the money anyways as we're looking to address severe inflation as a specific outcome.

Alternatively, you could sell derivatives on existing assets to fund the LEAP calls.

Curious if anyone else is thinking about this stuff?

I'm starting this thread for fun. The approaches discussed are not ideas typical investors should seriously consider let alone actually execute. This is intended for the finance geeks who like thinking about/discussing this stuff.

With that disclaimer out there...

I've made a couple of posts about the potential for substantial inflation but don't want to derail those threads with this topic.

(https://www.early-retirement.org/fo...ion-is-here-to-stay-109440-4.html#post2616686)

The constant theme, however, is that we don't really know.

So, I started thinking about exotic approaches to inflation protection. Not run of the mill asset allocation type stuff, but positions designed to deal with a severe inflation.

Crypto is often discussed as a new vehicle for hedging inflation, but I feel the sheer volatility and uncertainy would compound rather than hedge risk.

But using derivatives, maybe amped up with leverage, could create positions where you're likely to lose a relatively small amount of money but if you win, you can win big.

Rather than buying and holding assets with the intent of hedging inflation, which ties up loads of money for a long time, this could be an opportunity to use LEAP calls on ETFs that are likely to rise in the face of inflation.

Candidates

GLD (Gold)

XLRE (Real Estate)

VXUS (International)

VWO (emerging markets)

TIP (TIPS bonds)

You might also go for LEAP puts on long duration bond ETFs.

If you wanted to really go for it, perhaps a Pledged Asset Line or HELOC would be a vehicle to fund this. A 2-3% APR loan would allow you to tie up very little money at low carrying cost that could be used to buy the derivatives. Of course the hurdle rate for success goes up, but you would be buying things that are well out of the money anyways as we're looking to address severe inflation as a specific outcome.

Alternatively, you could sell derivatives on existing assets to fund the LEAP calls.

Curious if anyone else is thinking about this stuff?