You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Latest Inflation Numbers and Discussion

- Thread starter Gumby

- Start date

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That short relief in grocery aisle seems to be trending backwards again. Eggs @ Aldi is $3 a dozen again (supposedly another avian flu), cocoa prices are at all time high, and energy prices are trending up so I don't see prices of groceries going down anytime soon.

...........

People commonly "dispute" national price trends by using their own anecdotes as "real" and labelling the national figures as faulty.

The error being made should be obvious.

For me, last week and today Eggs @ Aldi were $1.22 a dozen (large size).

Shows the local priced anecdote is not a national price.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

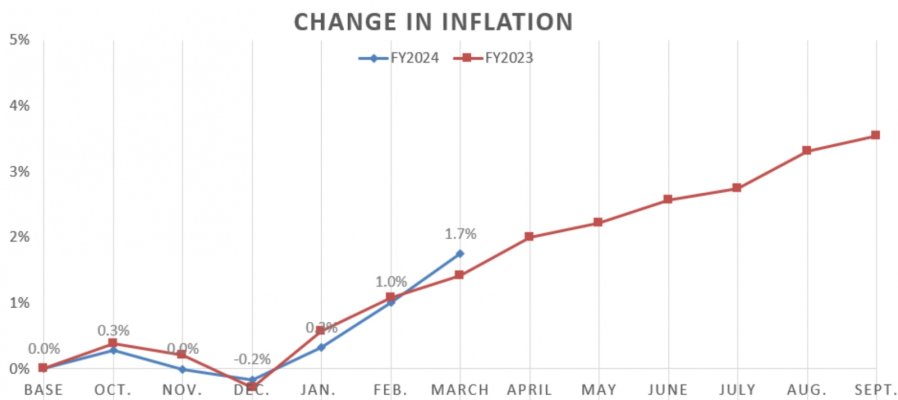

Same seasonal variation so far for sure. Interesting. I wasn’t aware of the pattern until recently.

People commonly "dispute" national price trends by using their own anecdotes as "real" and labelling the national figures as faulty.

The error being made should be obvious.

Exactly. Changes to one individual product, in one place, mean very little.

But even a humble consumer can see larger trends across all products in multiple regions. In fact, I'd put more faith in them than in some ivory-tower economist or (worse yet) political committee report. We've experienced the reality. We're not trying to grab headlines, grants or votes.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The Producer Price Index (PPI) registerd 0.2% in March, down sharply from 0.6% last month, and below the 0.3% expected.

Core PPI was 0.2%, as expected.

This breaks the string of higher than expected inflation readings, at least for now.

https://www.cnbc.com/2024/04/11/ppi...sale-prices-rose-0point2percent-in-march.html

Core PPI was 0.2%, as expected.

This breaks the string of higher than expected inflation readings, at least for now.

https://www.cnbc.com/2024/04/11/ppi...sale-prices-rose-0point2percent-in-march.html

Closet_Gamer

Thinks s/he gets paid by the post

I continue to be a pessimist on the inflation front. I think it will not only be sticky but may in fact rebound and require further tightening (QT or rates).

I think there are four forces that are hard to stop.

1 - Federal deficit spending.

2 - China decoupling. Government policy and companies diversifying their supply chains both result in work being done in higher cost areas.

3 - Low mortgage lock-in. People with 3% mortgages simply cannot sell their homes and move because they can't afford a 7% mortgage. Keeps home supplies tight and prices high which echos into rents.

4 - Work aversion. There is something unhealthy loose in society. I'm not making a broad, "no one wants to work" assertion but I do believe there is real productivity being lost at the margin. Absent a real recession, companies are being cautious about flushing these folks out of their payrolls. Salaries are being paid without full productivity out of the roles.

All four of these problems seem structural and I don't see any of them abating. If the market concludes this is a more likely outcome, we may see a breathtaking drop in equities and, to a lesser extent, fixed income. A lot of this rally has been driven by rate cut expectations. We could easily see Dow 30K again if the herd gets spooked.

I hope I'm wrong.

I think there are four forces that are hard to stop.

1 - Federal deficit spending.

2 - China decoupling. Government policy and companies diversifying their supply chains both result in work being done in higher cost areas.

3 - Low mortgage lock-in. People with 3% mortgages simply cannot sell their homes and move because they can't afford a 7% mortgage. Keeps home supplies tight and prices high which echos into rents.

4 - Work aversion. There is something unhealthy loose in society. I'm not making a broad, "no one wants to work" assertion but I do believe there is real productivity being lost at the margin. Absent a real recession, companies are being cautious about flushing these folks out of their payrolls. Salaries are being paid without full productivity out of the roles.

All four of these problems seem structural and I don't see any of them abating. If the market concludes this is a more likely outcome, we may see a breathtaking drop in equities and, to a lesser extent, fixed income. A lot of this rally has been driven by rate cut expectations. We could easily see Dow 30K again if the herd gets spooked.

I hope I'm wrong.

misanman

Thinks s/he gets paid by the post

- Joined

- Apr 28, 2008

- Messages

- 1,254

A Trillion Dollars in new deficit spending in the last 6 months

Just anecdotal, but DD is a financial secretary with a small non-profit and she just submitted a $90,000 claim for Covid relief money. This is for an organization with three full timers and 3-4 part timers. I'm sure the ask for bigger businesses would be much more. Have no idea of when these $$ run out and surprised that they are still be distributed.

38Chevy454

Thinks s/he gets paid by the post

Energy cost increases will spread throughout the economy. This alone is strong headwind against any inflation rate reduction. The non-stop gov't spending on so many wasteful projects or ideas is also causing strong resistance to any reduction in inflation rate. Between these two factors, it seems that the chart shown by braumeister will follow similar path this year.

So mentally preparing myself that costs of most things will continue to be high and going up rather than staying flat or slight reductions.

So mentally preparing myself that costs of most things will continue to be high and going up rather than staying flat or slight reductions.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I continue to be a pessimist on the inflation front. I think it will not only be sticky but may in fact rebound and require further tightening (QT or rates).

I think there are four forces that are hard to stop.

1 - Federal deficit spending.

2 - China decoupling. Government policy and companies diversifying their supply chains both result in work being done in higher cost areas.

3 - Low mortgage lock-in. People with 3% mortgages simply cannot sell their homes and move because they can't afford a 7% mortgage. Keeps home supplies tight and prices high which echos into rents.

4 - Work aversion. There is something unhealthy loose in society. I'm not making a broad, "no one wants to work" assertion but I do believe there is real productivity being lost at the margin. Absent a real recession, companies are being cautious about flushing these folks out of their payrolls. Salaries are being paid without full productivity out of the roles.

All four of these problems seem structural and I don't see any of them abating. If the market concludes this is a more likely outcome, we may see a breathtaking drop in equities and, to a lesser extent, fixed income. A lot of this rally has been driven by rate cut expectations. We could easily see Dow 30K again if the herd gets spooked.

I hope I'm wrong.

I think this is largely correct that these are inflation headwinds. The China decoupling may not increase costs much as China is not as inexpensive as it once was and places like Vietnam or Mexico may be rather competitive.

Interest rates cut both ways. The higher rates probably deter new purchases more than otherwise due to reduced affordability.

I think these are reasons the Fed may revisit its target. The 2% is lower than historical averages and may be more appropriate for a very slow growing economy without these inflationary pressures.

For me, last week and today Eggs @ Aldi were $1.22 a dozen (large size).

Shows the local priced anecdote is not a national price.

Count yourself lucky as $3 is the national cpi avg so looks like your area is the outlier.

https://www.cnn.com/2024/04/03/business/egg-prices-cal-maine-bird-flu/index.html

In terms of rent prices, I don't understand how one can expect it to subside (unless landlords are willing to take loss) when housing prices are still strong (increase in property taxes every year), every insurance renewal price is through the roof (pun intended). My increase in the last two years has been 25% and 35% respectively and that's rather mild compared to some of my friends and family where I've heard as high as 50% increase from the previous year.

Like all things its local, our city changed zoning and building laws in the last 5 years and builders are finally building apartments again so we finally saw a 0.5% rent decrease YoY.

We haven't seen the price jumps in insurance yet, but I'm waiting, we renewed in December and it was only a few more dollars which shocked me.

Thats why I find the data fascinating as its so different city to city.

Count yourself lucky as $3 is the national cpi avg so looks like your area is the outlier.

https://www.cnn.com/2024/04/03/business/egg-prices-cal-maine-bird-flu/index.html

Outlier?

Assuming a normal distribution, 50% of areas would be lower (and 50% of areas would be higher).

The quoted article talks about what might happen in the future due to a bird flu outbreak, not the distribution of egg prices.

Work aversion.

I think we may have seen this before.

Attachments

Like all things its local, our city changed zoning and building laws in the last 5 years and builders are finally building apartments again so we finally saw a 0.5% rent decrease YoY.

We haven't seen the price jumps in insurance yet, but I'm waiting, we renewed in December and it was only a few more dollars which shocked me.

Thats why I find the data fascinating as its so different city to city.

In our area it's crazy what the rental rates have risen to. There's definitely a shortage of smaller starter homes and 1-2 bedroom rental units which is keeping prices of both pretty high and I haven't seen any noticeable reductions. My auto, home and umbrella policies all renewed over the last few months and I was expecting some big increases and like you mine were actually less than inflation.

<snip> My auto, home and umbrella policies all renewed over the last few months and I was expecting some big increases and like you mine were actually less than inflation.

22% increase on the motor home insurance and 33% increase on the homeowners insurance. Both will renew in next month at the increased price.

I continue to be a pessimist on the inflation front. I think it will not only be sticky but may in fact rebound and require further tightening (QT or rates).

I think there are four forces that are hard to stop.

1 - Federal deficit spending.

2 - China decoupling. Government policy and companies diversifying their supply chains both result in work being done in higher cost areas.

3 - Low mortgage lock-in. People with 3% mortgages simply cannot sell their homes and move because they can't afford a 7% mortgage. Keeps home supplies tight and prices high which echos into rents.

4 - Work aversion. There is something unhealthy loose in society. I'm not making a broad, "no one wants to work" assertion but I do believe there is real productivity being lost at the margin. Absent a real recession, companies are being cautious about flushing these folks out of their payrolls. Salaries are being paid without full productivity out of the roles.

All four of these problems seem structural and I don't see any of them abating. If the market concludes this is a more likely outcome, we may see a breathtaking drop in equities and, to a lesser extent, fixed income. A lot of this rally has been driven by rate cut expectations. We could easily see Dow 30K again if the herd gets spooked.

I hope I'm wrong.

All good points... add on to the fact of birth decline and aging population in most developed countries which will put even more inflationary pressure on society.

Count yourself lucky as $3 is the national cpi avg so looks like your area is the outlier.

https://www.cnn.com/2024/04/03/business/egg-prices-cal-maine-bird-flu/index.html

Outlier?

Assuming a normal distribution, 50% of areas would be lower (and 50% of areas would be higher).

The quoted article talks about what might happen in the future due to a bird flu outbreak, not the distribution of egg prices.

Outlier - a data point on a graph or in a set of results that is very much bigger or smaller than the next nearest data point.

I would call less than 50% ($1.22) of the current national avg price of eggs of $3 an outlier.

Also it would help if you actually read the article before commenting. This is directly from the article.

The average price of a dozen Grade A large eggs was $3 in February, according to the latest Consumer Price Index, up from around $2 in the fall. While egg prices are down from a record $4.82 in January 2023 — after a widespread bird flu outbreak ravaged farms in the prior year — they’re now at the highest level since April 2023.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Personally, I think inflation is all relative, we do not really experience any hardships from it. Not to say that others do not.

We do not borrow any money, we do not have a mortgage, we do have a car lease but that does not seem to be affected. We were offered a great deal on a new car lease, better than what we have now, and we have only had our car for 2 years.

As for food and fuel again, we have not really noticed anything detrimental.

As for insurance in our case we have been lucky, apart from normal increases that are inevitable, we have not seen any dramatic increases.

Just because it is new for this year and makes good news .... I wonder why?

Inflation is a fact of life, like death and taxes, it will increase on an annual basis .... get over it.

We do not borrow any money, we do not have a mortgage, we do have a car lease but that does not seem to be affected. We were offered a great deal on a new car lease, better than what we have now, and we have only had our car for 2 years.

As for food and fuel again, we have not really noticed anything detrimental.

As for insurance in our case we have been lucky, apart from normal increases that are inevitable, we have not seen any dramatic increases.

Just because it is new for this year and makes good news .... I wonder why?

Inflation is a fact of life, like death and taxes, it will increase on an annual basis .... get over it.

Last edited:

Winemaker

Thinks s/he gets paid by the post

A three bedroom house apartment we sold in November last year, we rented at $800/month. It was vacant when we sold, he now gets $1200/month. It was a nice apartment, but I never thought it could rent that high! Oh well, the building made us wealthy at our rates.

ownyourfuture

Thinks s/he gets paid by the post

- Joined

- Jun 18, 2013

- Messages

- 1,561

4 - Work aversion. There is something unhealthy loose in society. I'm not making a broad, "no one wants to work" assertion but I do believe there is real productivity being lost at the margin. Absent a real recession, companies are being cautious about flushing these folks out of their payrolls. Salaries are being paid without full productivity out of the roles.

My brother has been at a fortune 500 company distribution center for 25 years, and what they have to let employees get by with when it comes to things like attendance & productivity figures is astounding.

Outlier - a data point on a graph or in a set of results that is very much bigger or smaller than the next nearest data point.

I would call less than 50% ($1.22) of the current national avg price of eggs of $3 an outlier.

Might be, might not be. Without knowing the distribution of egg prices over the US you're eyeballing and guessing.

A quick check shows the price of a dozen large white eggs at the local Wal-Mart is $1.90.

Also it would help if you actually read the article before commenting. This is directly from the article.

The average price of a dozen Grade A large eggs was $3 in February, according to the latest Consumer Price Index, up from around $2 in the fall. While egg prices are down from a record $4.82 in January 2023 — after a widespread bird flu outbreak ravaged farms in the prior year — they’re now at the highest level since April 2023.

It would help if you read what I wrote before commenting. I said the article doesn't address the distribution of egg prices, and it doesn't. Your quote from the article addresses the change in average price over time, not the distribution.

I don't think people will get over it as they see those 20% to 50% increases in insurance and home maintenance costs. The hardship is experienced more by the general public than early retirees with nice stashes. That's why it's just big news and a top concern for so many Americans. For me, it's not about a hardship as much as it just means I have to reduce my discretionary spending to make up the difference on the required expenses. But so many people are struggling, and we are still well above the 2% inflation target (core PCE), which was already too high for so many people.Inflation is a fact of life, like death and taxes, it will increase on an annual basis .... get over it.

So it varies at Walmart locations also. They were $2.06 at my Walmart for the cheapest dozen eggs days ago, and just confirmed online as well. But they were close to $3 a few weeks earlier. That's the only price decrease I've seen.Might be, might not be. Without knowing the distribution of egg prices over the US you're eyeballing and guessing.

A quick check shows the price of a dozen large white eggs at the local Wal-Mart is $1.90.

Last edited:

So it varies at Walmart locations also. They were $2.06 at my Walmart for the cheapest dozen eggs days ago, and just confirmed online as well. But they were close to $3 a few weeks earlier. That's the only price decrease I've seen.

We bought eggs at a local discount supermarket yesterday at $1.79. I don't specifically track local egg prices, but do remember swings from $0.99 [Easter special, the only time I've seen them near that low] to almost $3 during the past year.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We have tried all types of eggs, even the so-called specialty eggs and honestly, we find the Walmart extra-large (Blue Package) at $2.32 doz. the best for the price. I think we kinda know too as we come from the UK that have "Real Eggs"  ) LOL), or at least used to. They are probably just like the mass-produced rubbish we get here over there too by now though.

) LOL), or at least used to. They are probably just like the mass-produced rubbish we get here over there too by now though.

Similar threads

- Replies

- 25

- Views

- 517

- Replies

- 188

- Views

- 22K

- Replies

- 140

- Views

- 6K

- Sticky

- Replies

- 236

- Views

- 30K