I don't think that's accurate. These programs (Quicken/Moneydance) appear to use OFX Direct. This allows a direct connection between your computer and the financial institution. For example, I see that Schwab Bank uses a direct connection to 'https://ofx.schwab.com'.

I think the only 3rd party part is the OFX database that stores financial institutions and their details. Once you know those details, I don't think you need to connect to the 3rd party site, you'd only connect directly with the financial institution.

However, looking at the Moneydance output, it looks like Schwab isn't working. I'm getting an 'access denied' error and reddit says that Schwab pulled OFX/Direct Connect support. So much for that. Even though there's a post on the reddit thread that indicates Schwab discontinued OFX and is going to provide their own APIs (

https://www.reddit.com/r/GnuCash/comments/jyc66b/schwab_ofx_discontinued/).

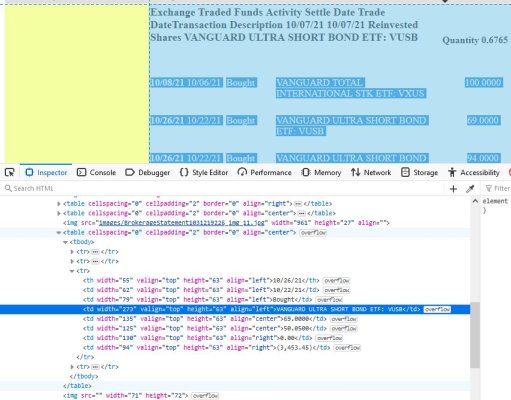

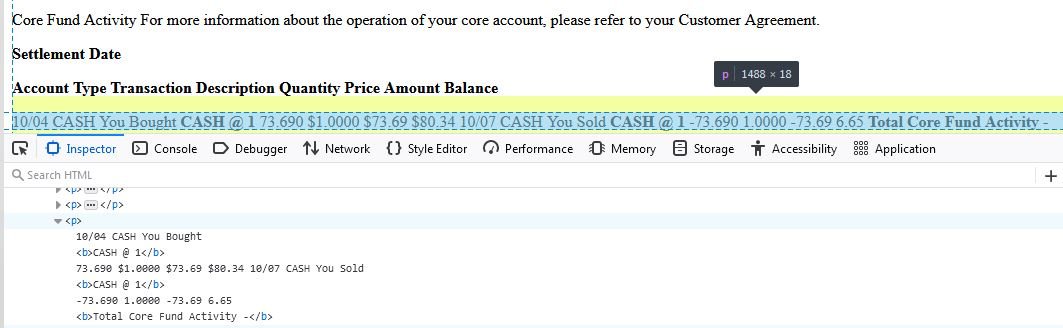

As for Fidelity, OFX/Direct Connect still works and it connects to 'https://ofx.fidelity.com'.

If you're using python, there's an oxftools library that you could use. It looks like you have to enter your username/password and you'd want to review the code to make sure it's not doing anything nefarious. Here's some documentation which shows how it works:

https://ofxtools.readthedocs.io/en/latest/client.html.

Of course, this isn't for everybody, but if you're ok with how it works and spend time to understand what it's doing, it could be a solution.