You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Fidelity Retirement Analysis Tool

- Thread starter G-Man

- Start date

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I believe that most (all?) calculators assume income first and then w/d from one's own retirement investments to provide one's retirement expenses. If somebody can live on income alone, be it SS, or pension, or any other source outside of their own investments, then the investments will not be tapped and go to zero unless there is a worldwide financial collapse.

Well yes.

In G Man's thought process, by default the investments are being used to cover some of the expenses. So if they go to zero, conceptually if one were still to have a successful remaining years of retirement, one would then need to cut their expenses down to just the income stream available.

Well yes.

In G Man's thought process, by default the investments are being used to cover some of the expenses. So if they go to zero, conceptually if one were still to have a successful remaining years of retirement, one would then need to cut their expenses down to just the income stream available.

Correct. That was my use case.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This may open up a can of worms, but it’s something I noticed this morning after doing a proforma tax return for 2023. The planner estimates your taxes. It’s not called out, but it is the difference between your budgeted expenses and income withdrawn from the account. Fidelity had mine at over $10,000 owed in taxes and my actual taxes will be about $4500. So as many have said before about the tool, it leans conservative. You likely are in better shape than it shows.

latexman

Thinks s/he gets paid by the post

This may open up a can of worms, but it’s something I noticed this morning after doing a proforma tax return for 2023. The planner estimates your taxes. It’s not called out, but it is the difference between your budgeted expenses and income withdrawn from the account. Fidelity had mine at over $10,000 owed in taxes and my actual taxes will be about $4500. So as many have said before about the tool, it leans conservative. You likely are in better shape than it shows.

That's understandable. Taxes are so very complex, and can vary greatly from person to person. I ASSuME Fidelity treats it like all income is earned income with standard deduction; no tax free $, no capital gain $, no special exemptions, no losses, no itemizing, etc. It's NOT a tax program, it's a retirement planner. Get close enough, but on the conservative side!

NXR7

Recycles dryer sheets

COcheesehead said:This may open up a can of worms, but it’s something I noticed this morning after doing a proforma tax return for 2023. The planner estimates your taxes.

It’s not called out, but it is the difference between your budgeted expenses and income withdrawn from the account. Fidelity had mine at over $10,000 owed in taxes and my actual taxes will be about $4500. So as many have said before about the tool, it leans conservative. You likely are in better shape than it shows.

Yes, that was one of their less-than-brilliant changes several years ago. The planner used to allow you to enter specific percentages for federal, state, and city income tax rates. I used the numbers from my tax returns.

Then Fidelity decided their algorithms are smarter than reality and significantly diminished the value of future projections and the planner in general.

This may open up a can of worms, but it’s something I noticed this morning after doing a proforma tax return for 2023. The planner estimates your taxes. It’s not called out, but it is the difference between your budgeted expenses and income withdrawn from the account. Fidelity had mine at over $10,000 owed in taxes and my actual taxes will be about $4500. So as many have said before about the tool, it leans conservative. You likely are in better shape than it shows.

Some what are the columns in the tabular format that is being used to calculate the taxes?

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Some what are the columns in the tabular format that is being used to calculate the taxes?

Take the total expense column and subtract the retirement expense total you entered into the budget area. The difference is what Fidelity calculates as your taxes. Your retirement expenses should not include taxes because the tool estimates (over estimates for me) the tax.

Take the total expense column and subtract the retirement expense total you entered into the budget area. The difference is what Fidelity calculates as your taxes. Your retirement expenses should not include taxes because the tool estimates (over estimates for me) the tax.

Thanks

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

This is a very informative thread. I've got a couple of brokerage accounts with Fidelity and my employer also uses them to manage/deposit RSU's, so Fidelity advisors have been calling me from time to time to sign me up for their Private Client Group. I finally took the bait and had an intro call, which went well, so will definitely consider. Anyhow, they pointed out the analysis tool, so I went in and populated it. It's a bit clunky, but once you get the hang of it has proven a valuable addition to my slate of financial tools. More importantly, if I do decide go with a Fidelity advisor and consolidate my portfolio with them, this will be an important means of analysis between us.

Should add, most importantly, FWIW, its giving me the thumbs up on FIRE even in the most severe market case! Biggest "complaint" is that wish it would provide the option of showing more of the detail of the behind the scenes calculations (taxes, yields, failure rates, etc.).

Should add, most importantly, FWIW, its giving me the thumbs up on FIRE even in the most severe market case! Biggest "complaint" is that wish it would provide the option of showing more of the detail of the behind the scenes calculations (taxes, yields, failure rates, etc.).

Last edited:

This is a very informative thread. I've got a couple of brokerage accounts with Fidelity and my employer also uses them to manage/deposit RSU's, so Fidelity advisors have been calling me from time to time to sign me up for their Private Client Group. I finally took the bait and had an intro call, which went well, so will definitely consider. Anyhow, they pointed out the analysis tool, so I went in and populated it. It's a bit clunky, but once you get the hang of it has proven a valuable addition to my slate of financial tools. More importantly, if I do decide go with a Fidelity advisor and consolidate my portfolio with them, this will be an important means of analysis between us.

Should add, most importantly, FWIW, its giving me the thumbs up on FIRE even in the most severe market case! Biggest "complaint" is that wish it would show more of the behind the scenes calculations (taxes, yields, failure rates, etc.).

There is a PDF document that describes the back-end methodology and assumptions being used. I believe you can download it within the Retirement Planning tool itself.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Should add, most importantly, FWIW, its giving me the thumbs up on FIRE even in the most severe market case! Biggest "complaint" is that wish it would provide the option of showing more of the detail of the behind the scenes calculations (taxes, yields, failure rates, etc.).

Keep in mind that the most severe case is equal to success in 90% of the scenarios. This concept in the default success rate of Firecalc is 95%.

It is reasonably comparable, as the Fidelity methodology uses a Monte Carlo simulation which is inherently more conservative than a historical sequential model used in Firecalc. Plus there is a first year haircut taken in Fidelity.

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

Keep in mind that the most severe case is equal to success in 90% of the scenarios. This concept in the default success rate of Firecalc is 95%.

It is reasonably comparable, as the Fidelity methodology uses a Monte Carlo simulation which is inherently more conservative than a historical sequential model used in Firecalc. Plus there is a first year haircut taken in Fidelity.

Thanks - took me awhile playing with it and some reading thru this thread and the PDF that G-Man recommended to figure out some of the peculiarities of this model, especially the upfront haircut part. Kept messing with it trying to understand where the rest of my portfolio went. Well, seems that SORR took a big bite out of it! Thanks for confirming!

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks - took me awhile playing with it and some reading thru this thread and the PDF that G-Man recommended to figure out some of the peculiarities of this model, especially the upfront haircut part. Kept messing with it trying to understand where the rest of my portfolio went. Well, seems that SORR took a big bite out of it! Thanks for confirming!

A couple of other tidbits is that mortgage expenses are treated different from rent expenses.

The standard overall inflation rate used is 2.5%, while 4.9% is the inflation rate for medical expenses and it decreases over time.

Al18

Full time employment: Posting here.

Fidelity’s tool does a good job of telling you if you have enough to retire, but it does not do a good job of figuring taxes - especially if you are doing Roth IRA conversions.

LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

Fidelity’s tool does a good job of telling you if you have enough to retire, but it does not do a good job of figuring taxes - especially if you are doing Roth IRA conversions.

Yup, seems completely black-box on taxes; wish would provide some details and/or allow for a bit of customization. But, just goes to show that no one tool/model is comprehensive enough - helps to be adept at a handful of them for various purposes and comparison.

For some reason this morning, I no longer see a link to the Fidelity Retirement planner tool when I log into my Fidelity account. Are others having the same issue?

If someone has the direct link to the tool, can you please post it.

Thanks

If someone has the direct link to the tool, can you please post it.

Thanks

The Cosmic Avenger

Thinks s/he gets paid by the post

https://myguidance.fidelity.com/ftgw/pna/customer/planning/goals/retirementFor some reason this morning, I no longer see a link to the Fidelity Retirement planner tool when I log into my Fidelity account. Are others having the same issue?

If someone has the direct link to the tool, can you please post it.

Thanks

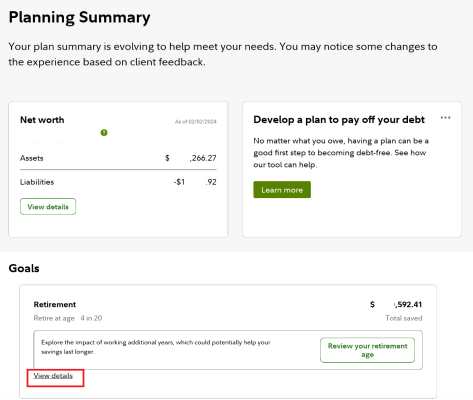

I can still navigate there by going to Planning & Advice, My Goals, then scroll down and click View Details under your Retirement goal, but it took me a while to figure that out, for weeks I've been getting there by typing "retirement" in the address bar and it populated it from my browser history.

I don't know why they're hiding it, the retirement budget tool is one of the most useful things on the site.

Last edited:

https://myguidance.fidelity.com/ftgw/pna/customer/planning/goals/retirement

I can still navigate there by going to Planning & Advice, My Goals, then scroll down and click View Details under your Retirement goal, but it took me a while to figure that out, for weeks I've been getting there by typing "retirement" in the address bar and it populated it from my browser history.

I don't know why they're hiding it, the retirement budget tool is one of the most useful things on the site.

Not seeing the View Details under Retirement goal. Can you post a screenshot. I'm seeing a different screen.

I see a "View Details" under my Net Worth. When I click on View Details, it takes me to the Fidelity Full View planning tool. Not the other planning tool when it gives you a score, etc.

Last edited:

RetireBy90

Thinks s/he gets paid by the post

I opened portfolio, summary and on right hand side I see a link to "Review your Plan"

I opened portfolio, summary and on right hand side I see a link to "Review your Plan"

That is where I normally see it. However, for some reason today, I don't see it.

Can someone provide a direct link to the tool.

Last edited:

Direct link to tool as requested: https://myguidance.fidelity.com/ftgw/pna/customer/planning/goals/retirement

Direct link to tool as requested: https://myguidance.fidelity.com/ftgw/pna/customer/planning/goals/retirement

I got in with that direct link. Thank you.

The Cosmic Avenger

Thinks s/he gets paid by the post

This is what I see when I go to My Goals. I've highlighted the "View Details" link that I can use, although I also have the URL I gave bookmarked.Not seeing the View Details under Retirement goal. Can you post a screenshot. I'm seeing a different screen.

I see a "View Details" under my Net Worth. When I click on View Details, it takes me to the Fidelity Full View planning tool. Not the other planning tool when it gives you a score, etc.

Attachments

This is what I see when I go to My Goals. I've highlighted the "View Details" link that I can use, although I also have the URL I gave bookmarked.

Thanks for providing the screenshot. For some reason, my planning summary page is different. However, I got in using the direct link from the previous poster. Really weird this morning.

Similar threads

- Replies

- 1

- Views

- 696

- Replies

- 0

- Views

- 230