wmc1000

Thinks s/he gets paid by the post

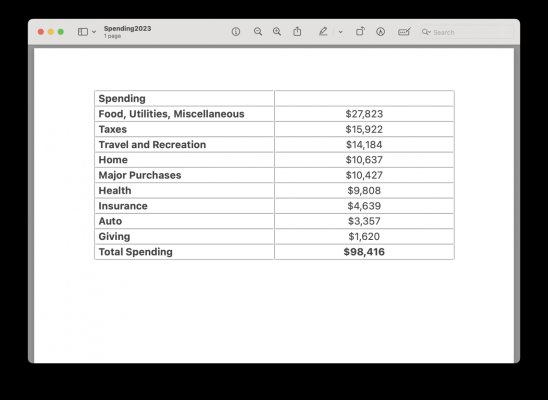

Generally I don’t know all my annual spending until all the credit card statements that include Dec charges come in. This takes me until Jan 22 thereabouts.

I look at our CC account online to get the final pending charges included in our totals.

Also, I am anal about owing anything to anyone so I almost always make CC payments that keep us without a balance due BEFORE the monthly statement is even sent out. Also do that with our utility biils, just call me crazy.