FUEGO

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 13, 2007

- Messages

- 7,746

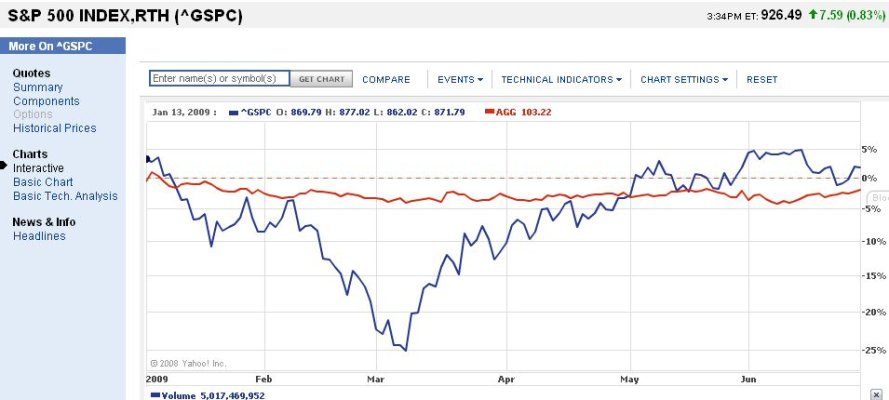

After six consecutive quarters with negative returns, the S&P 500 index fund (at Vanguard) is one day away from posting a 16% quarterly return. That would be the largest quarterly return in at least the last ten years, slightly edging out the 15.4% returns of Q2 2003.

It is also up around 36% from its early March lows.

Sooo... I guess we'll have a very happy "Post your quarterly returns" thread in another day or two (at least for those who followed the "and hold" part of the buy and hold strategy). Barring an exciting day June 30, that is.

It is also up around 36% from its early March lows.

Sooo... I guess we'll have a very happy "Post your quarterly returns" thread in another day or two (at least for those who followed the "and hold" part of the buy and hold strategy). Barring an exciting day June 30, that is.