COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can see why this process is hard for you. I asked a simple question - do you need the income- and I got your response above. I am not trying to be mean, but you really seem to be over thinking this or maybe I just see things in a simpler manner.Our current yearly income needs of $150 k to $175 k are met by -

1) DW SSI

2)Dividends around $100k

3)Draw from taxable, rebalancing & keeping the AA 70/30 - Pass on to kids with step up basis, when we pass

4) Use IRAs for Roth conversions only

5) Roth accounts to be used in future for Nursing Home money or pass on to kids

Hope I answered your question

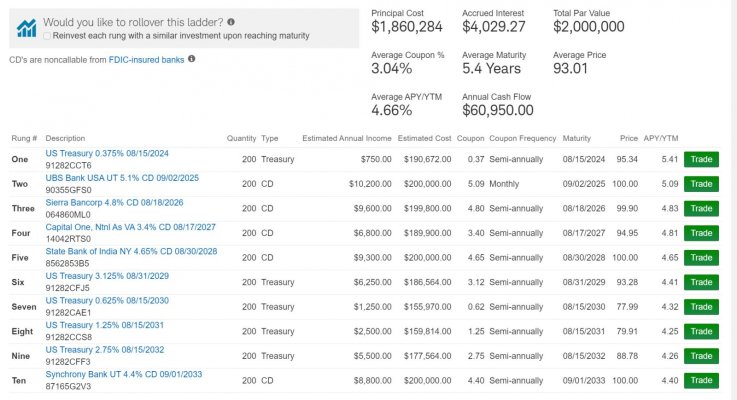

I am going to guess and say you need income for #3. So you need liquidity for rebalancing. I would ladder super safe CDs, agencies and or treasuries. All of which can be bought off a yield table https://fixedincome.fidelity.com/ftgw/fi/FILanding

I would set up 6 -12 month rungs and go out five years. You then would only have to make 1-2 buys a year, have cash for rebalancing and have all the interest deposited into a MM or core cash account for spending. It doesn’t get much simpler than that. You’ll probably make a 5%+ ish yield, but never lose a dime if you hold until maturity.

Fidelity used to also for no extra fee, set up a ladder for you. I am not sure if they charge for that service now, but that is another easy way to get the ball rolling.

I wish you good luck.