My demonstrated lack of knowledge in bonds has led me to try and understand - plus I'm looking for a place to put some money. So much expertise in these forums, I'm hoping you can help. I'm using my TD account to make some observations.

Individual Bonds - reasonably easy to understand in theory, but getting bogged down in specifics. I will use CIUSP 05531FAV5 for reference (no good reason)

1) It seems most bonds have a par value of $1000, but I read that some do not. How do I know the par value? I see nothing on my TD screen for that bond that says the par value. I guess I can infer from a "Call Sched" that says "04-09-2021@100.000 0.560." I guess the par value is 10x100=1000, but shouldn't it be explicitly stated if not all bonds are par 1000?

2) Why on earth is the price of a bond an order of magnitude less than par? (e.g. $103 when it will really cost you $1030). That is not done with stocks - the price of a share is the price of a share.

3) Price of bond changes with interest rates etc. Where can I find of graph of the price for 05531FAV5? Since this is so hard to find (I have not), I assume it must somehow not be important?

4) How do I measure liquidity of a bond? For a stock, I know that I can sell GE, AMZN, or TSLA immediately if I want. I'm not sure how I know that, but I do. There are other stocks that are not like that, but I stay away. How do I know that I can quickly sell an individual bond? For 05531FAV5, TD is showing me that a small "depth of market" table with two rows. One for quantity 21 at price X and one for quantity 100 at price Y. Does that mean in the entire world there are only quantity 121 for sale and it is not very liquid? Could I get stuck not being able to sell these bonds?

5) If I buy a bond and hold it until maturity, is the par value ($1000) just dumped into my account or do I have to somehow redeem it?

6) As I understand it, all bond interest payments are taxed at your normal income rate? There is no equivalent of "qualified" dividends in the equities world?

7) As far as estimating income, do I care most about the current yield, yield to maturity, or yield to worst. That is, how much exactly are the interest payments going to be?

Bonds Funds and ETFs

1) When I look at available bonds from TDAmeritrade, everything short term is very low yield. Like the absolute highest is 1.87% for something in the 1-3 year range. So how is something like VFSUX quoting a yield of 2.82%? And that yield is on what - the amount I bought or some underlying par value?

2) I do not understand how I am supposed to know if an individual Fund or ETF is trading at a discount or premium. Again using VSFUX, current price is $10.75. If I actually buy that fund, do I pay 10 times that per share ($107.5) like I would with an individual bond? I'm guessing not. Now, I understand that the discount/premium would be calculated based on the NAV. Fine, I have the NAV - but how do I get the numerator to know? Or am I just assuming for some reason that anything above $10 is a premium?

Bonds vs Bond Funds

If individual bonds effectively have a guaranteed return of principal (except for default), why buy funds and ETFs?

Yikes. Told you I did not understand.

Individual Bonds - reasonably easy to understand in theory, but getting bogged down in specifics. I will use CIUSP 05531FAV5 for reference (no good reason)

1) It seems most bonds have a par value of $1000, but I read that some do not. How do I know the par value? I see nothing on my TD screen for that bond that says the par value. I guess I can infer from a "Call Sched" that says "04-09-2021@100.000 0.560." I guess the par value is 10x100=1000, but shouldn't it be explicitly stated if not all bonds are par 1000?

2) Why on earth is the price of a bond an order of magnitude less than par? (e.g. $103 when it will really cost you $1030). That is not done with stocks - the price of a share is the price of a share.

3) Price of bond changes with interest rates etc. Where can I find of graph of the price for 05531FAV5? Since this is so hard to find (I have not), I assume it must somehow not be important?

4) How do I measure liquidity of a bond? For a stock, I know that I can sell GE, AMZN, or TSLA immediately if I want. I'm not sure how I know that, but I do. There are other stocks that are not like that, but I stay away. How do I know that I can quickly sell an individual bond? For 05531FAV5, TD is showing me that a small "depth of market" table with two rows. One for quantity 21 at price X and one for quantity 100 at price Y. Does that mean in the entire world there are only quantity 121 for sale and it is not very liquid? Could I get stuck not being able to sell these bonds?

5) If I buy a bond and hold it until maturity, is the par value ($1000) just dumped into my account or do I have to somehow redeem it?

6) As I understand it, all bond interest payments are taxed at your normal income rate? There is no equivalent of "qualified" dividends in the equities world?

7) As far as estimating income, do I care most about the current yield, yield to maturity, or yield to worst. That is, how much exactly are the interest payments going to be?

Bonds Funds and ETFs

1) When I look at available bonds from TDAmeritrade, everything short term is very low yield. Like the absolute highest is 1.87% for something in the 1-3 year range. So how is something like VFSUX quoting a yield of 2.82%? And that yield is on what - the amount I bought or some underlying par value?

2) I do not understand how I am supposed to know if an individual Fund or ETF is trading at a discount or premium. Again using VSFUX, current price is $10.75. If I actually buy that fund, do I pay 10 times that per share ($107.5) like I would with an individual bond? I'm guessing not. Now, I understand that the discount/premium would be calculated based on the NAV. Fine, I have the NAV - but how do I get the numerator to know? Or am I just assuming for some reason that anything above $10 is a premium?

Bonds vs Bond Funds

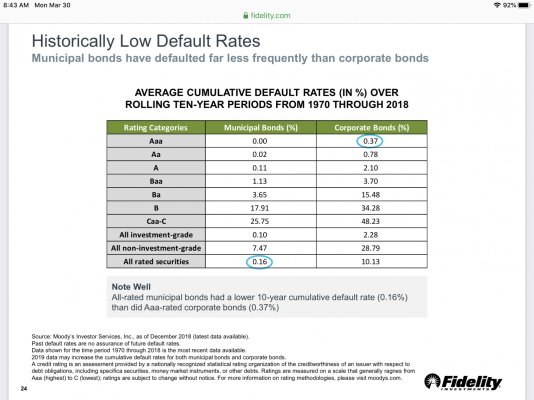

If individual bonds effectively have a guaranteed return of principal (except for default), why buy funds and ETFs?

Yikes. Told you I did not understand.