Best ways to beat SPY are Wisdom Tree's Efficient core (symbol NTSX) or RPAR.

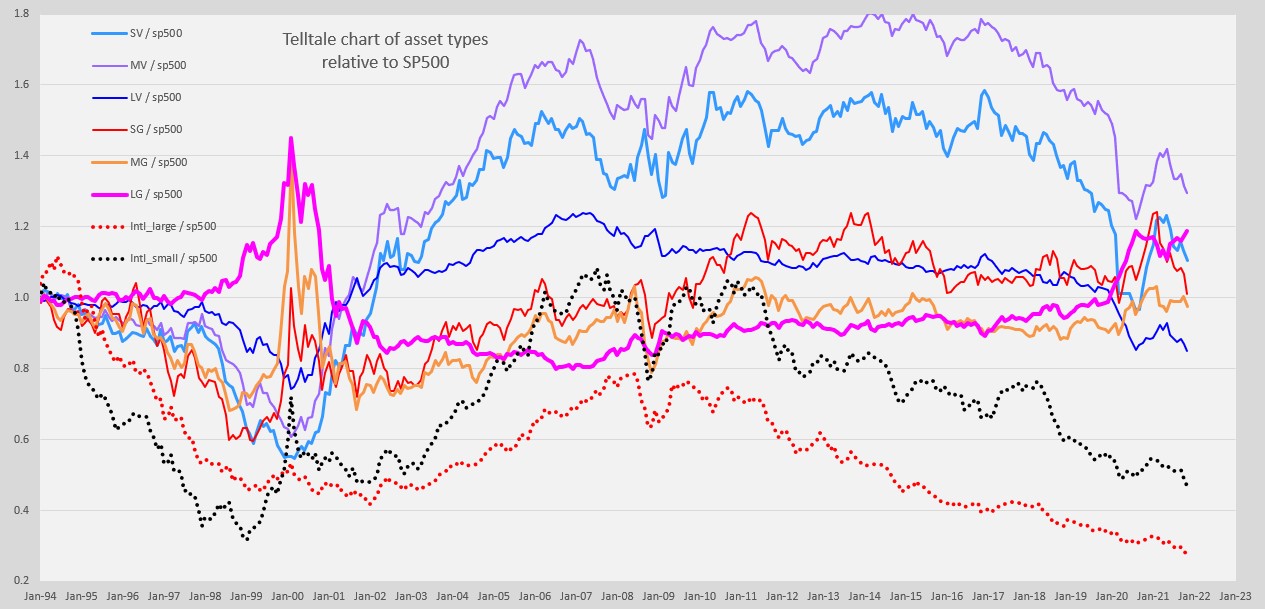

I also have backtested a "risk parity" portfolio that wins handily over time and mimics what a lot of the big hedge funds and Goldman do. YES YES YES with the secular bull in Treasuries perhaps ending, the negative correlation of Treasuries will diminish, but with quarterly rebalancing the formula still delivers huge gains over SPY by about 460 basis points with almost HALF the volatility/drawdowns.

Curious what folks here think?

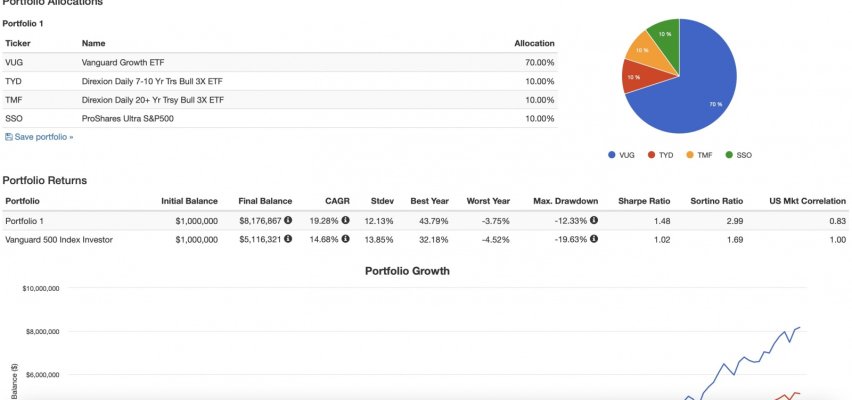

VUG - 70%

TYD - 10%

TMF - 10%

SSO - 10%

I also have backtested a "risk parity" portfolio that wins handily over time and mimics what a lot of the big hedge funds and Goldman do. YES YES YES with the secular bull in Treasuries perhaps ending, the negative correlation of Treasuries will diminish, but with quarterly rebalancing the formula still delivers huge gains over SPY by about 460 basis points with almost HALF the volatility/drawdowns.

Curious what folks here think?

VUG - 70%

TYD - 10%

TMF - 10%

SSO - 10%