Hi Forum,

long time lurker since a while, heard about ER / FIRE 5 years ago.

Originally from Germany, moved to Switzerland >10 years ago, all together with my DW (41yo, too). Focussing on our jobs, friends, amazing vacations and no children but pets as a substitute ( ), which was great so far.

), which was great so far.

But for the first one at least myself is now in a situation where I get paid a good amount of money, but the fun is lacking since >three years. I´m feeling exhausted about w*rk and don´t believe this feeling would be gone just by switching jobs. Not to mention that it won't be easy to get a similar salary elsewhere, since the current one was clearly (even though "deserved") by being "in the right place at the right time.", four years ago.

Therefore I´d try to stay a couple of years longer, as this shortens the time until finally getting FI. Plan is to RE way before 2030 - not sure if this is going to be realistic, but hey, a man needs a plan

Net worth target: 3.0m CHF (when moving back to GER) - 4.6m CHF (when staying in CH)

Expected yearly spend: 108k (GER) - 160k (CH)

Current yearly spend: 135k + separate taxes on salary

Cola´d state pension (available in 2047) current value: 27.6k

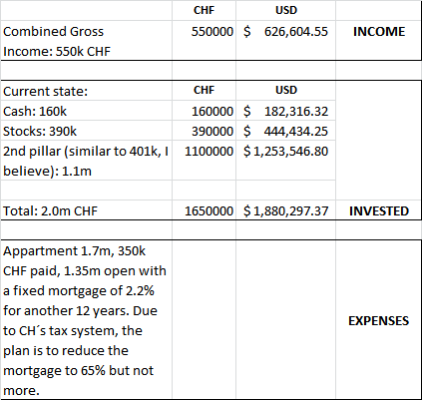

Combined Gross Income: 550k CHF

Current state:

Cash: 160k

Stocks: 390k

2nd pillar (similar to 401k, I believe): 1.1m

Appartment 1.7m, 350k CHF paid, 1.35m open with a fixed mortgage of 2.2% for another 12 years. Due to CH´s tax system, the plan is to reduce the mortgage to 65% but not more.

Total: 2.0m CHF

Networth increase over the previous years and including 2023 so far: 136k (2019), 357k (2020), 373k (2021), 60k (2022, what a year!), 292k (2023 so far).

I will use this thread to provide quarterly updates, and answer any question

long time lurker since a while, heard about ER / FIRE 5 years ago.

Originally from Germany, moved to Switzerland >10 years ago, all together with my DW (41yo, too). Focussing on our jobs, friends, amazing vacations and no children but pets as a substitute (

But for the first one at least myself is now in a situation where I get paid a good amount of money, but the fun is lacking since >three years. I´m feeling exhausted about w*rk and don´t believe this feeling would be gone just by switching jobs. Not to mention that it won't be easy to get a similar salary elsewhere, since the current one was clearly (even though "deserved") by being "in the right place at the right time.", four years ago.

Therefore I´d try to stay a couple of years longer, as this shortens the time until finally getting FI. Plan is to RE way before 2030 - not sure if this is going to be realistic, but hey, a man needs a plan

Net worth target: 3.0m CHF (when moving back to GER) - 4.6m CHF (when staying in CH)

Expected yearly spend: 108k (GER) - 160k (CH)

Current yearly spend: 135k + separate taxes on salary

Cola´d state pension (available in 2047) current value: 27.6k

Combined Gross Income: 550k CHF

Current state:

Cash: 160k

Stocks: 390k

2nd pillar (similar to 401k, I believe): 1.1m

Appartment 1.7m, 350k CHF paid, 1.35m open with a fixed mortgage of 2.2% for another 12 years. Due to CH´s tax system, the plan is to reduce the mortgage to 65% but not more.

Total: 2.0m CHF

Networth increase over the previous years and including 2023 so far: 136k (2019), 357k (2020), 373k (2021), 60k (2022, what a year!), 292k (2023 so far).

I will use this thread to provide quarterly updates, and answer any question

Last edited: