I did it. FIREd as of 7/16/21 at age 47.

Quick “FIRE Bio:”

Discovered I could make money not working from interest sometime in junior high school; I think from reading about CDs in Zillions or Penny Power Magazine (Consumer Report’s kids magazine back in the 80’s). After mediocre high school performance I went to college because it was expected (and I didn’t know what else to do) and graduated with honors with double majors in Marketing (started as marketing) and Finance (really liked finance). Thought I wanted to be an investment advisor until I interned one summer with a major brokerage house and realized they were all evil (late 90s). After graduation, I was not real confident (in hindsight, I was very competent but had no experience/validation, or mentors) and took the first/only job offer I got out of college and began working for the government as a budget analyst. Started with no debt, a couple thousand dollars and a used kind of crappy car.

In college, I had a goal of saving $1,000,000. What I really wanted was to be financially independent and quickly reframed the goal. I quickly discovered John Greaney’s community on The Motley Fool (before TMF became “wise” and before the forums turned into a politicized cesspool), the Terhorsts, “The Joy of Not Working,” etc. (I laugh now when I hear of MMM, and others being founders of the FIRE movement!) and started eyeing 40 as a goal to be FI. I probably could have done it but got married/divorced and had some lifestyle creep during marriage that I’ve unwound since my divorce several years ago.

My career was never fulfilling, I did fairly well and was well regarded but plateaued fairly quickly as I’m not political, hate BS and bureaucracy, inefficiency, and incompetence. It was a job, only had a couple “work friends” over the course of my career but only work in common and didn’t socialize outside the office at all. The first half of my career was mostly with a very toxic boss and the last half was mostly absentee leadership (https://hbr.org/2018/03/the-most-common-type-of-incompetent-leader). The last few years felt like high school again, something I had to do but didn’t like and found to be soul sucking and I found myself mostly “coping” at work every day. I didn’t “hate it” but hated wasting my life there and left feeling drained most days. It did give me a very secure financial footing with nice golden handcuffs if I had stayed (I very roughly calculate that not waiting to MRA of 57 cost me at a minimum $2.5M in benefits and value of continued compounding and additional savings). What’s 10 years of my life worth…. More than $2.5M apparently since I just quit!

Fire Journey:

Contributed heavily to the TSP (always to match and ramped up to max as soon as my income/expenses allowed). Opened a Roth IRA as soon as I could afford to and maxed it out as well. In addition, saved a decent chunk AT as well. Avoided debt other than mortgages (and paid them down fairly aggressively) and one auto loan (put 50% down and paid off the 3-year note in 1 year because I hate paying interest). My investments have all been equity, mostly index but I did start buying individual stocks (DRIPS!) in college and played around with a handful over the years. I enjoy evaluating the companies but found I was better at finding buys than selling in a disciplined manner. I did beat the market slightly but not worth the risk/work to even consider with more than a tiny fraction of my portfolio.

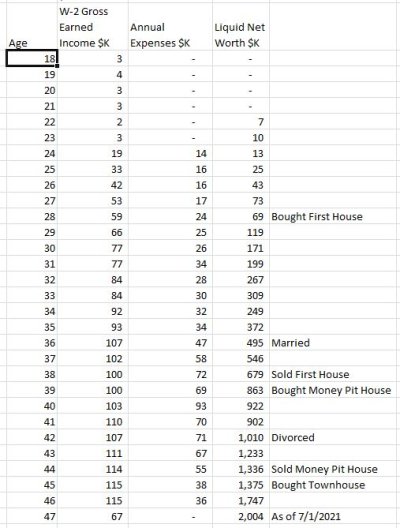

At least one person has asked so here are some of the numbers year to year. It is interesting for me to look back and I can identify every market and life event that impacted my journey. The take away lesson is that I always had good habits and good habits will more than make up for some really expensive/bad mistakes over time.

~2% of NW is Cash

~2% of NW is i-Bonds from late 90s/early 2000s (Diamond Hands till maturity!)

~16% of NW is AT Investments

~18% of NW is ROTH IRA

~61% of NW is TSP

For projecting cash flow, I am planning on expenses of $44K, even though my actual these last few years has been significantly lower. It may be high but inflation is creeping up, spending may have been influenced by COVID restrictions, and my spending could increase in FIRE although I think I’ll be pretty stingy my first year or two as I adjust to the shift from the accumulation phase. If I stay this lean, my portfolio should continue to grow but I do see my expenses rising faster than inflation for a few years as I age (healthcare, conveniences I wouldn’t consider now, etc).

My withdraw strategy will flex depending on conditions each year. For now, I have enough cash to cover me through 2022. I will sell in my taxable account up to ACA/CG thresholds to replenish cash/harvest CG and do that until my taxable account gets to some as yet undefined level. I will then start a SEPP from TSP (and it may cover all my expenses so I can let the taxable ride or blow it!). Even if I don’t need the money, I will likely start the SEPP in several years to mitigate RMD impacts in future years. The Roth is sort of an insurance policy that I don’t expect to tap right away. I will also get a small deferred annuity starting when I am 60. I also have a HELOC I can tap to dampen shocks and cash flow expenses to defer income realization into the future tax years if necessary.

Reflections

I wish I invested more time and energy to get promoted to the next tier so that when my income plateaued I was at a higher rate of pay for the same amount of BS.

Would have got a pre-nuptial agreement when I got married (I had assets, she had negative NW). Fortunately, we were amicable and did what I would have asked for in an agreement but I got lucky. I also would have tried a little harder to repair the marriage… comes with hindsight and we were both just full of contempt for each other and it takes two to work things out and she had given up more than me. We were both glad to just walk away.

I was generally hands off on my investments but occasionally pulled some cash back when I thought the market was frothy… not a huge amount and less driven by fear than greed as I wanted dry powder for when the correction came. Never once did I call the top even close.

I’d have invested in real estate earlier. At 47 I don’t have the time/energy/motivation to buy an income property but wish I did when I was younger. The limiting factors then was liquidity (but I could have overcome that pretty easily) and possibly fear as it would have been a substantial portion of my NW at the start. A bit of diversification and free cash flow from a property I have owned for years would be real nice to have now.

If I say it out loud, $2M sounds like a huge amount of assets but I feel “poor” right now and expect I’ll be pretty frugal (extremely?) for some period of time as I adjust to the post-accumulation phase. If the market continues to treat me well, as it has, I look forward to eventually Blowing That Dough! It is impressive that my liquid net worth is higher than my estimated lifetime earnings; I don’t find it surprising as I know how the math works but still mind blowing and outside of our small community, very few would be able to fathom/believe it to be possible.

I guess that’s it. I did well but never made huge money and was disciplined and ruthless in my saving. I never felt deprived and for the most part bought whatever I wanted. I don’t know how I feel at this point; I guess mild happiness. The actual last day was sort of anticlimactic due to a pretty empty office. I think it will be a few days weeks before it sinks in. I’ll try posting updates occasionally on this thread as my journey unfolds.

The numbers:

Expenses were adjusted for the married years to reflect my expenses only and not her spending.

Net Worth is liquid assets only excluding HSA Balance (For now it’s bonus/insurance)

Quick “FIRE Bio:”

Discovered I could make money not working from interest sometime in junior high school; I think from reading about CDs in Zillions or Penny Power Magazine (Consumer Report’s kids magazine back in the 80’s). After mediocre high school performance I went to college because it was expected (and I didn’t know what else to do) and graduated with honors with double majors in Marketing (started as marketing) and Finance (really liked finance). Thought I wanted to be an investment advisor until I interned one summer with a major brokerage house and realized they were all evil (late 90s). After graduation, I was not real confident (in hindsight, I was very competent but had no experience/validation, or mentors) and took the first/only job offer I got out of college and began working for the government as a budget analyst. Started with no debt, a couple thousand dollars and a used kind of crappy car.

In college, I had a goal of saving $1,000,000. What I really wanted was to be financially independent and quickly reframed the goal. I quickly discovered John Greaney’s community on The Motley Fool (before TMF became “wise” and before the forums turned into a politicized cesspool), the Terhorsts, “The Joy of Not Working,” etc. (I laugh now when I hear of MMM, and others being founders of the FIRE movement!) and started eyeing 40 as a goal to be FI. I probably could have done it but got married/divorced and had some lifestyle creep during marriage that I’ve unwound since my divorce several years ago.

My career was never fulfilling, I did fairly well and was well regarded but plateaued fairly quickly as I’m not political, hate BS and bureaucracy, inefficiency, and incompetence. It was a job, only had a couple “work friends” over the course of my career but only work in common and didn’t socialize outside the office at all. The first half of my career was mostly with a very toxic boss and the last half was mostly absentee leadership (https://hbr.org/2018/03/the-most-common-type-of-incompetent-leader). The last few years felt like high school again, something I had to do but didn’t like and found to be soul sucking and I found myself mostly “coping” at work every day. I didn’t “hate it” but hated wasting my life there and left feeling drained most days. It did give me a very secure financial footing with nice golden handcuffs if I had stayed (I very roughly calculate that not waiting to MRA of 57 cost me at a minimum $2.5M in benefits and value of continued compounding and additional savings). What’s 10 years of my life worth…. More than $2.5M apparently since I just quit!

Fire Journey:

Contributed heavily to the TSP (always to match and ramped up to max as soon as my income/expenses allowed). Opened a Roth IRA as soon as I could afford to and maxed it out as well. In addition, saved a decent chunk AT as well. Avoided debt other than mortgages (and paid them down fairly aggressively) and one auto loan (put 50% down and paid off the 3-year note in 1 year because I hate paying interest). My investments have all been equity, mostly index but I did start buying individual stocks (DRIPS!) in college and played around with a handful over the years. I enjoy evaluating the companies but found I was better at finding buys than selling in a disciplined manner. I did beat the market slightly but not worth the risk/work to even consider with more than a tiny fraction of my portfolio.

At least one person has asked so here are some of the numbers year to year. It is interesting for me to look back and I can identify every market and life event that impacted my journey. The take away lesson is that I always had good habits and good habits will more than make up for some really expensive/bad mistakes over time.

~2% of NW is Cash

~2% of NW is i-Bonds from late 90s/early 2000s (Diamond Hands till maturity!)

~16% of NW is AT Investments

~18% of NW is ROTH IRA

~61% of NW is TSP

For projecting cash flow, I am planning on expenses of $44K, even though my actual these last few years has been significantly lower. It may be high but inflation is creeping up, spending may have been influenced by COVID restrictions, and my spending could increase in FIRE although I think I’ll be pretty stingy my first year or two as I adjust to the shift from the accumulation phase. If I stay this lean, my portfolio should continue to grow but I do see my expenses rising faster than inflation for a few years as I age (healthcare, conveniences I wouldn’t consider now, etc).

My withdraw strategy will flex depending on conditions each year. For now, I have enough cash to cover me through 2022. I will sell in my taxable account up to ACA/CG thresholds to replenish cash/harvest CG and do that until my taxable account gets to some as yet undefined level. I will then start a SEPP from TSP (and it may cover all my expenses so I can let the taxable ride or blow it!). Even if I don’t need the money, I will likely start the SEPP in several years to mitigate RMD impacts in future years. The Roth is sort of an insurance policy that I don’t expect to tap right away. I will also get a small deferred annuity starting when I am 60. I also have a HELOC I can tap to dampen shocks and cash flow expenses to defer income realization into the future tax years if necessary.

Reflections

I wish I invested more time and energy to get promoted to the next tier so that when my income plateaued I was at a higher rate of pay for the same amount of BS.

Would have got a pre-nuptial agreement when I got married (I had assets, she had negative NW). Fortunately, we were amicable and did what I would have asked for in an agreement but I got lucky. I also would have tried a little harder to repair the marriage… comes with hindsight and we were both just full of contempt for each other and it takes two to work things out and she had given up more than me. We were both glad to just walk away.

I was generally hands off on my investments but occasionally pulled some cash back when I thought the market was frothy… not a huge amount and less driven by fear than greed as I wanted dry powder for when the correction came. Never once did I call the top even close.

I’d have invested in real estate earlier. At 47 I don’t have the time/energy/motivation to buy an income property but wish I did when I was younger. The limiting factors then was liquidity (but I could have overcome that pretty easily) and possibly fear as it would have been a substantial portion of my NW at the start. A bit of diversification and free cash flow from a property I have owned for years would be real nice to have now.

If I say it out loud, $2M sounds like a huge amount of assets but I feel “poor” right now and expect I’ll be pretty frugal (extremely?) for some period of time as I adjust to the post-accumulation phase. If the market continues to treat me well, as it has, I look forward to eventually Blowing That Dough! It is impressive that my liquid net worth is higher than my estimated lifetime earnings; I don’t find it surprising as I know how the math works but still mind blowing and outside of our small community, very few would be able to fathom/believe it to be possible.

I guess that’s it. I did well but never made huge money and was disciplined and ruthless in my saving. I never felt deprived and for the most part bought whatever I wanted. I don’t know how I feel at this point; I guess mild happiness. The actual last day was sort of anticlimactic due to a pretty empty office. I think it will be a few days weeks before it sinks in. I’ll try posting updates occasionally on this thread as my journey unfolds.

The numbers:

Expenses were adjusted for the married years to reflect my expenses only and not her spending.

Net Worth is liquid assets only excluding HSA Balance (For now it’s bonus/insurance)

Attachments

Last edited: