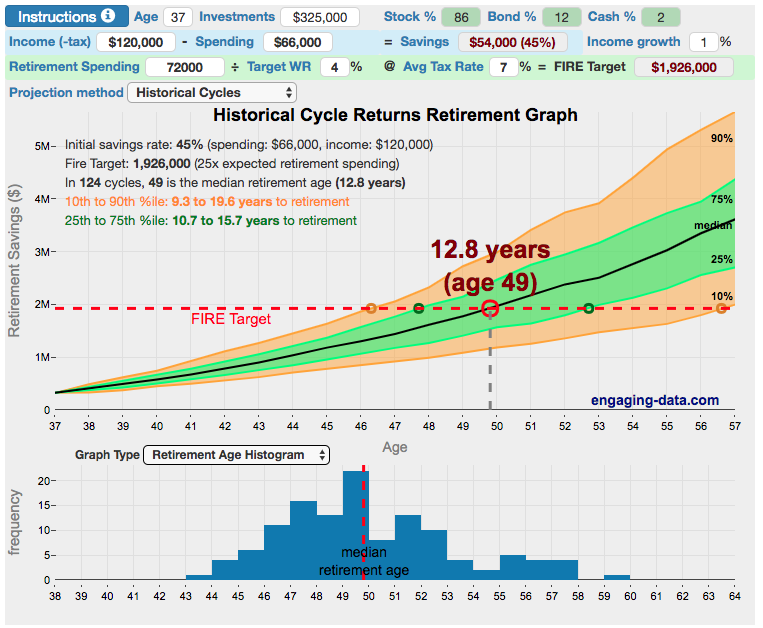

What tools do you use to estimate the time it'll take you to FIRE? I've seen some online calculators but they are a little underwhelming (i.e. Networthify).

They assume a fixed return on investment and no asset allocation.

FIRECalc would be interesting to use given all the data embedded within, but it doesn't seem to be able to run in "when will I hit my magic number?" mode.

Does anyone have a go-to tool they use for projecting when they'll be able to pull the plug?

They assume a fixed return on investment and no asset allocation.

FIRECalc would be interesting to use given all the data embedded within, but it doesn't seem to be able to run in "when will I hit my magic number?" mode.

Does anyone have a go-to tool they use for projecting when they'll be able to pull the plug?

Technical error I am sure.

Technical error I am sure.