Haven't gotten figures back from the CPA but likely $30k+ fed and $7-9 State. I took full SS mid year and have been doing Roth conversions at what the RMD would be. Sort of ambivalent on the Roth conversions but do like idea of lowering the tIRA; my biggest reason is what surviving spouse would pay as single tax payer. Anyway, as my good friend the mutual fund and pension fund manager used to say, nothing wrong with paying income taxes....means you have income.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much do you pay in income taxes(State and Federal) each year?

- Thread starter FANOFJESUS

- Start date

- Status

- Not open for further replies.

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

Since we retired the feds yearly average is about $1,000 and the state is about $6,500. And this is a no income tax state but they get other ways.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

copyright1997reloaded

Thinks s/he gets paid by the post

After seeing my income spike the last few years due to large cap gain distributions from a stock fund, I switched to a stock index fund to eliminate them. That not only reduced my income taxes but also put me back on the ACA premium subsidy train.

For 2020, I paid 3.7% in state income taxes and 3.0% in federal income taxes.

THIS is part of the reason most of my taxable accounts are individual stocks, whose capital gain distribution (or loss for that matter) is managed by me.

euro

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2015

- Messages

- 2,341

Still drawing deferred compensation from my megacorp job, so State+Fed income taxes are well into 6 figures.... but I don't fret about it. The scheme allowed me to save significant taxes while I was still employed. The piper has to paid at SOME Point!

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I thought money taken from a conventional IRA was taxed as ordinary income.

At the federal level, that's true. I assume Sunset was referring to the state tax treatment. Many states give tax breaks to retirees.

ETA: Sunset also might be referring to a Roth IRA.

Last edited:

When I worked, I made a fairly good salary and we paid fairly for our business income.....taxes were, to me, so high how could it get worse. Well, now we pay more in taxes than we ever showed as earned income. NO, I do not think its fair. Just because we were smart and invested well we get to give it all to the Feds. Thank you ACA and your great tax on our labor that keeps giving. If it were turned around, they would not tax your pension as much as the "pension" we now get from our investment in business. I know we are not alone in this unfair taxation, which will now get even worse. Not only do we get no 0% bracket capital gains, we get to pay extra tax on both captial gains and investment income another 3.8% on top, and to dig the dagger deeper, we get to subsidize everyone elses Medicare with onerous IRMAA taxes, after paying full tax for 40 years for both SS and Medicare on income. This is a true joke on wage earning tax payers who actually worked and invested to retire, only to have a disproportionate share taxed because they were successful. Maybe we should just give our rentals to the homeless and let them pay taxes. Oh, wait, our state did that for us this year, thank you.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Unfair compared to...?When I worked, I made a fairly good salary and we paid fairly for our business income.....taxes were, to me, so high how could it get worse. Well, now we pay more in taxes than we ever showed as earned income. NO, I do not think its fair. Just because we were smart and invested well we get to give it all to the Feds. Thank you ACA and your great tax on our labor that keeps giving. If it were turned around, they would not tax your pension as much as the "pension" we now get from our investment in business. I know we are not alone in this unfair taxation, which will now get even worse. Not only do we get no 0% bracket capital gains, we get to pay extra tax on both captial gains and investment income another 3.8% on top, and to dig the dagger deeper, we get to subsidize everyone elses Medicare with onerous IRMAA taxes, after paying full tax for 40 years for both SS and Medicare on income. This is a true joke on wage earning tax payers who actually worked and invested to retire, only to have a disproportionate share taxed because they were successful. Maybe we should just give our rentals to the homeless and let them pay taxes. Oh, wait, our state did that for us this year, thank you.

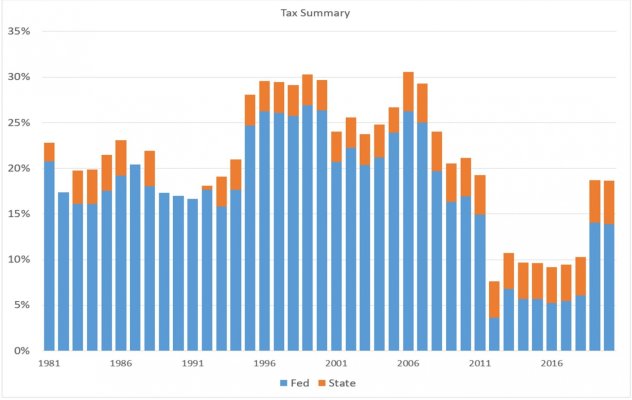

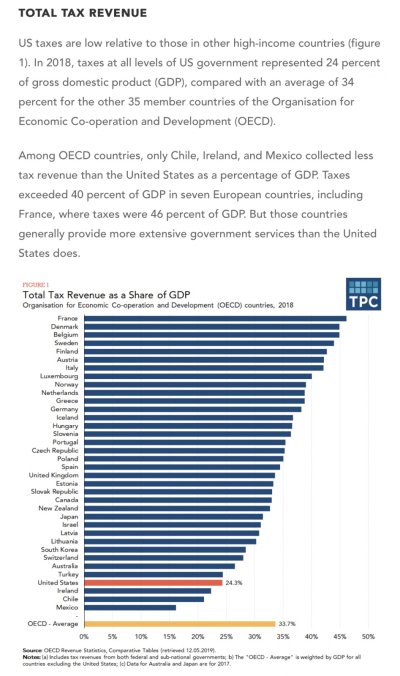

https://www.taxpolicycenter.org/briefing-book/how-do-us-taxes-compare-internationally

Attachments

Last edited:

gayl

Thinks s/he gets paid by the post

So what is the marginal Federal & state tax rate? Do you only get to keep 50c of the next $1? (FWIW I also worked, invested, pay highest Medicare B premium but shifted a lot of non-deductible IRA to Roth so that can't be taxed again)... we get to pay extra tax on both captial gains and investment income another 3.8% on top, and to dig the dagger deeper, we get to subsidize everyone elses Medicare with onerous IRMAA taxes, after paying full tax for 40 years for both SS and Medicare on income.....

Last edited:

mckittri2000

Recycles dryer sheets

$0 for 2019 and 2020 for the Feds. State was $45 in 2019 and $35 in 2020.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I thought money taken from a conventional IRA was taxed as ordinary income.

For Federal taxes is is regular income.

For IL money from Pensions, IRAs, 401K's is tax free (for now).

So I am happy to pull money out of my IRA to spend, as this is not taxed by IL.

My long term hope is we move to an income tax free State (FL, WA, NV, etc) and then I can cash in my LTCG's in my taxable account.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

At the federal level, that's true. I assume Sunset was referring to the state tax treatment. Many states give tax breaks to retirees.

ETA: Sunset also might be referring to a Roth IRA.

IL does not tax retirement income, so pensions, IRA/401K withdrawals are tax free.

We are actually building up our Roth by doing roth conversions and only paying Fed taxes on the conversions.

Thanks for the comparison, but you do understand the difference of fair taxation? Everyone should pay the same rate, it should not be so slanted to discourage you to earn or achieve more. The original intent of "income tax" was just that, income earned by work, not from investing in the country and growth of the GDP. Why can't we have a single flat tax for everyone, it would be equal, not fair, but what tax is truly fair?

I would not mind paying even an effective 25% tax, if everyone did like in many other countries. But in the USA, we (<1%) get to pay a much higher rate and the majority of the taxes, while the majority get to pay an effective rate so much lower. The tax structure penalizes those who work and are productive in favor of those who work less and are far less productive, or do not work at all. I am appalled how what I thought was a fair system, has now become a free ride for many paid for by the few. To answer one, I would rather live in Uruguay. Everyone gets a fair education, and tax is not overly weighted to those who have a true work ethic. Norway is also a fair state, they tax fairly and everyone shares in the wealth of the resources held by the country. Only in the USA do we get to pay a significantly higher share, for a marginally higher income. There are ways to be fair to those who have worked so many years to earn their standard of living. Taxing them, at the time they deserve the reward is unfair.

We are not the billionaires, we are those who are the working class that earned every Nickle, paid the tax along the way, and are now being taxed even more since we were smart enough to invest for 40 years or more.

The tax laws have been manipulated by interest groups leaving the true working class earners/achievers to pay the brunt of tax collected. How can anyone think the NIIT tax is even close to fair for those who invested in employing so many for so many years. Why is it fair to tax someone 20% to 30% more than others, just because they worked for it. It makes me want to gift it all to my children and be on the take like the many who scam on the ACA insurance and other programs poorly designed to promote manipulation of income. It is a total joke.

Next time you go to the store to buy milk just be thankful its not 2030 when they will evaluate your ability to pay and that 1/2 gallon will be 4x more if you can pay it. I am serious that day is coming as the current tax system is driving this very method. OH, why not tax the wealth of those with IRA's and Pension assets/ There is a lot of money out there and why should it not be spread to those who did not earn it, what makes you so special.

Or maybe you will be in the lucky margin where you get milk for free and pay no taxes, but are still allowed to travel with the money you are allowed to keep from your retirement because it is not worth going after. Who should decide what that amount is? Let me vote first. I think if you are eating tuna and not cat food, its OK, have the free milk, but then if you are able to buy swordfish we should make you pay so much more for any milk you need. Sure sounds fair to me. Lets put a NIIT tax on that milk so those eating cat food can get free milk with their heroin.

gayl

Thinks s/he gets paid by the post

I have more so I can afford to pay more. Life's good

Your comment "free milk with their heroin" is shocking

Your comment "free milk with their heroin" is shocking

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So move to Uruguay already.I would not mind paying even an effective 25% tax, if everyone did like in many other countries. But in the USA, we (<1%) get to pay a much higher rate and the majority of the taxes, while the majority get to pay an effective rate so much lower. The tax structure penalizes those who work and are productive in favor of those who work less and are far less productive, or do not work at all. I am appalled how what I thought was a fair system, has now become a free ride for many paid for by the few. To answer one, I would rather live in Uruguay. Everyone gets a fair education, and tax is not overly weighted to those who have a true work ethic. Norway is also a fair state, they tax fairly and everyone shares in the wealth of the resources held by the country. Only in the USA do we get to pay a significantly higher share, for a marginally higher income. There are ways to be fair to those who have worked so many years to earn their standard of living. Taxing them, at the time they deserve the reward is unfair.

Or maybe you will be in the lucky margin where you get milk for free and pay no taxes, but are still allowed to travel with the money you are allowed to keep from your retirement because it is not worth going after. Who should decide what that amount is? Let me vote first. I think if you are eating tuna and not cat food, its OK, have the free milk, but then if you are able to buy swordfish we should make you pay so much more for any milk you need. Sure sounds fair to me. Lets put a NIIT tax on that milk so those eating cat food can get free milk with their heroin.

Who are these people not paying their fair share in your view?

Just say the number 47 percent (now 44 percent according to TPC estimates) and many people know exactly what you are talking about: It was the calculation that the Tax Policy Center did a decade ago of the share of people who pay no federal income tax.

- The likelihood of not paying federal income tax is closely correlated to age: If you are very young or (especially) very old, you are far less likely to pay income tax than if you are working age. Only 11 percent of those age 25-55 do not pay federal income tax while more than 80 percent of those age 75 or older are non-payers.

- Relatively few people are persistent non-payers. Among those of prime working age who do not pay federal income tax in any given year, nearly one-third will do so for only one year. Almost 6 in 10 will be paying income tax within three years, and just one-in-eight are non-payers for a decade or more.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's annoying that so many have such a warped and unrealistic view of how much they pay in income taxes. I run into such ignorance all the time.

Here are effective federal tax rates for various amounts of income... one has to have a lot of income to end up at a 25% effective tax rate so I call BS. In any event, if your income is $1m and have a 25% effective tax rate then you aren't going to get a lot of sympathy.

MFJ, 2020:

And if you don't like it, move!

BTW, a flat tax would be totally unfair... let's say it was 10%... someone with $10k of income would pay $1k in tax and someone with $500k of income would only pay $50k in tax? Besides, the tax system has been progressive for our entire lifetime so it shouldn't be a big surprise to anyone who has been paying attention... and again if you don't like it then just move.

Here are effective federal tax rates for various amounts of income... one has to have a lot of income to end up at a 25% effective tax rate so I call BS. In any event, if your income is $1m and have a 25% effective tax rate then you aren't going to get a lot of sympathy.

MFJ, 2020:

| 100% Ordinary Income | 50% Ordinary, 50% Preferenced | |||

| Income | Federal income tax | Effective tax rate | Federal income tax | Effective tax rate |

| 100,000 | 8,320 | 8.3% | 2,320 | 2.3% |

| 200,000 | 29,583 | 14.8% | 22,210 | 11.1% |

| 300,000 | 54,583 | 18.2% | 42,952 | 14.3% |

| 400,000 | 82,613 | 20.7% | 65,283 | 16.3% |

| 500,000 | 117,250 | 23.5% | 88,583 | 17.7% |

| 600,000 | 153,150 | 25.5% | 114,323 | 19.1% |

| 700,000 | 141,083 | 20.2% | ||

| 800,000 | 171,613 | 21.5% | ||

| 900,000 | 202,700 | 22.5% | ||

| 1,000,000 | 235,050 | 23.5% | ||

And if you don't like it, move!

BTW, a flat tax would be totally unfair... let's say it was 10%... someone with $10k of income would pay $1k in tax and someone with $500k of income would only pay $50k in tax? Besides, the tax system has been progressive for our entire lifetime so it shouldn't be a big surprise to anyone who has been paying attention... and again if you don't like it then just move.

Last edited:

- Joined

- Apr 14, 2006

- Messages

- 23,112

MOD NOTE: If I recall correctly, the original question raised by the OP was how much do you pay in taxes? So let's all stick to the question and stay away from gratuitous rants about whether you feel the US income tax system is unfair, since a) they won't change anything, and b) many people disagree.

Ole Red 29

Recycles dryer sheets

in 2020 we paid to the top of the 24% federal tax bracket (~$66k), mainly in roth conversions. no state tax here.

A lot. $90,000-$120,000 a year for the last three years. Much of it due to selling appreciated assets. It does cause me not to sell too much in any one year. While my income is temporarily high it’s not permanent and is still unpleasant to lose upwards of 1/3 of your income.

euro

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2015

- Messages

- 2,341

I have more so I can afford to pay more. Life's good

Your comment "free milk with their heroin" is shocking

Exactly. ‘Nough said!

VanWinkle

Thinks s/he gets paid by the post

30K roth conversion this year, 3K fed and 0 state.

We convert to the top of the 22% bracket. So we pay a lot. But if you think about it... from the point of deferral to now, it was never "our" money anyway. It's just a question of when?... and what rate? I'm happy to settle-up at 22% while I can.

USGrant1962

Thinks s/he gets paid by the post

Fed and MD, I paid 25.1% on gross income, 31.3% on AGI in 2019.

Most of my income is my part time consulting gig that gets hammered by Self Employment Tax. OTOH, the difference between gross and AGI is solo 401(k), self employed health insurance, and the deductible part of self-employment tax, which is nice. I also get the QBI deduction between AGI and taxable. So net of the 15.4% self employment tax it is not horrible.

Most of my income is my part time consulting gig that gets hammered by Self Employment Tax. OTOH, the difference between gross and AGI is solo 401(k), self employed health insurance, and the deductible part of self-employment tax, which is nice. I also get the QBI deduction between AGI and taxable. So net of the 15.4% self employment tax it is not horrible.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We convert to the top of the 22% bracket. So we pay a lot. But if you think about it... from the point of deferral to now, it was never "our" money anyway. It's just a question of when?... and what rate? I'm happy to settle-up at 22% while I can.

I'm guessing that you avoided paying a lot more than 22% when you deferred that income.

- Status

- Not open for further replies.

Similar threads

- Replies

- 159

- Views

- 9K

- Replies

- 0

- Views

- 182