garcia2012

Confused about dryer sheets

- Joined

- Sep 22, 2012

- Messages

- 4

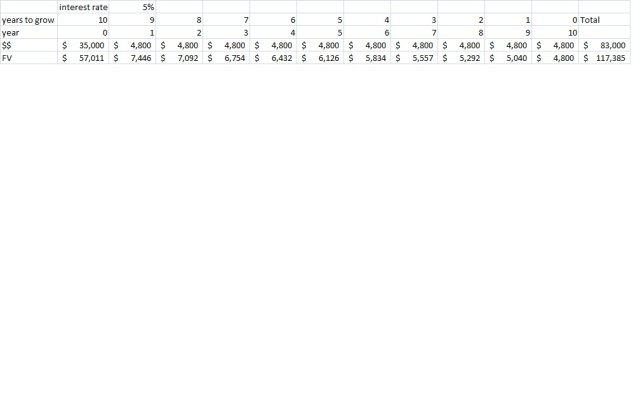

Please give your advice on how you would invest $35,000 that you can add $400 monthly to this investment with trying to make an average return of 5% or more for the total 10 year period. Then in 10 years you would need to cash in this investment and use the money.

If you started this investment before the end of 2012 then in 2013 onward you would have about $1,600 of tax free space left empty in a Roth IRA. You have a 7 month emergency fund, 0 debt, Taxes-married filing jointly, 15% Federal Tax, no state tax. I could also handle about a 15% risk.

Thanks for your help!

If you started this investment before the end of 2012 then in 2013 onward you would have about $1,600 of tax free space left empty in a Roth IRA. You have a 7 month emergency fund, 0 debt, Taxes-married filing jointly, 15% Federal Tax, no state tax. I could also handle about a 15% risk.

Thanks for your help!