The recent market gyrations have been nerve racking for most including myself. I haven't sold anything, but actually bought AAPl at 108.00 on monday.

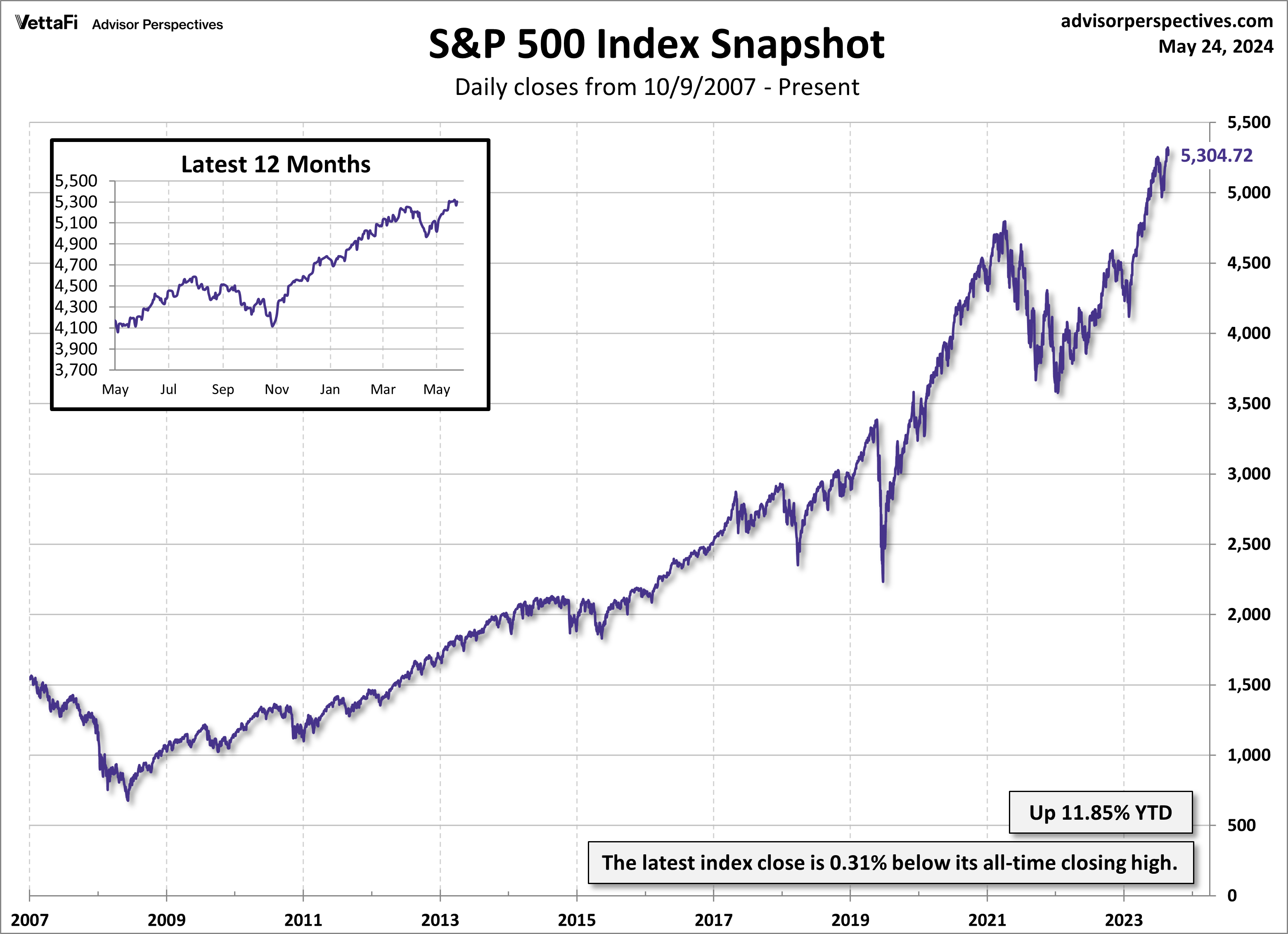

In an effort to compare my investment results with that of the market i compared the returns for the period 6/30/2015 (last brokerage statement) to last night's balance. I noticed that from 06/30/2015 THRU 08/25/2015 S&P-500 dropped 9.50% and my all stock portfolio with 6% cash reserves dropped 7.78%. Perhaps dividend income had something to do with my portfolio doing a little better than S&P-500! That made me feel reassured that my asset allocation and investment strategy is working and I will stay the course instead of trying to time the market.

Thanks.

In an effort to compare my investment results with that of the market i compared the returns for the period 6/30/2015 (last brokerage statement) to last night's balance. I noticed that from 06/30/2015 THRU 08/25/2015 S&P-500 dropped 9.50% and my all stock portfolio with 6% cash reserves dropped 7.78%. Perhaps dividend income had something to do with my portfolio doing a little better than S&P-500! That made me feel reassured that my asset allocation and investment strategy is working and I will stay the course instead of trying to time the market.

Thanks.