Stormy Kromer

Thinks s/he gets paid by the post

- Joined

- Oct 1, 2017

- Messages

- 1,159

In early October the Middle East was shook loose.

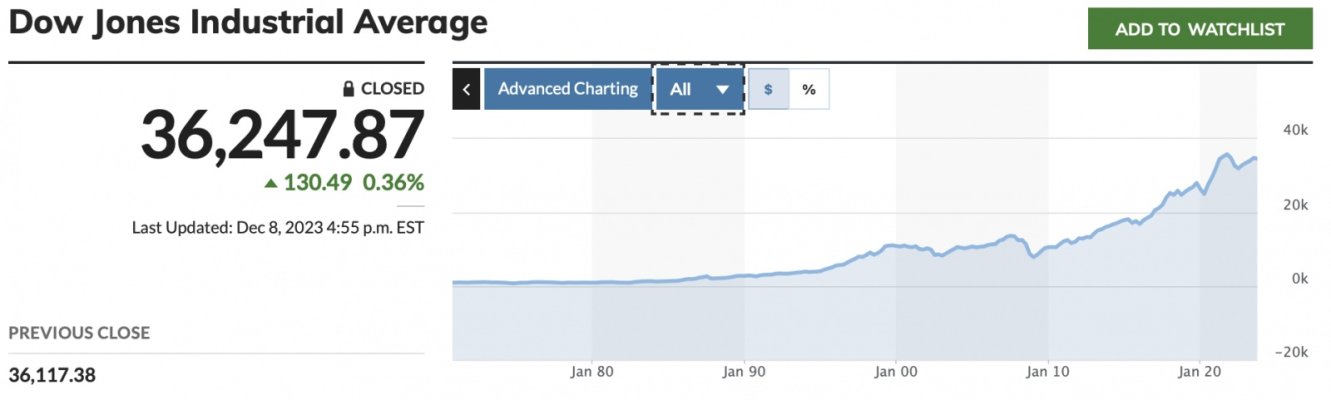

I told DW that "the DJ and S&P be down 20% this week and gasoline would be $5 bucks a gallon in the next two weeks"

I didn't do a thing and watched myself be wrong. Saved me a lot of money.

I told DW that "the DJ and S&P be down 20% this week and gasoline would be $5 bucks a gallon in the next two weeks"

I didn't do a thing and watched myself be wrong. Saved me a lot of money.