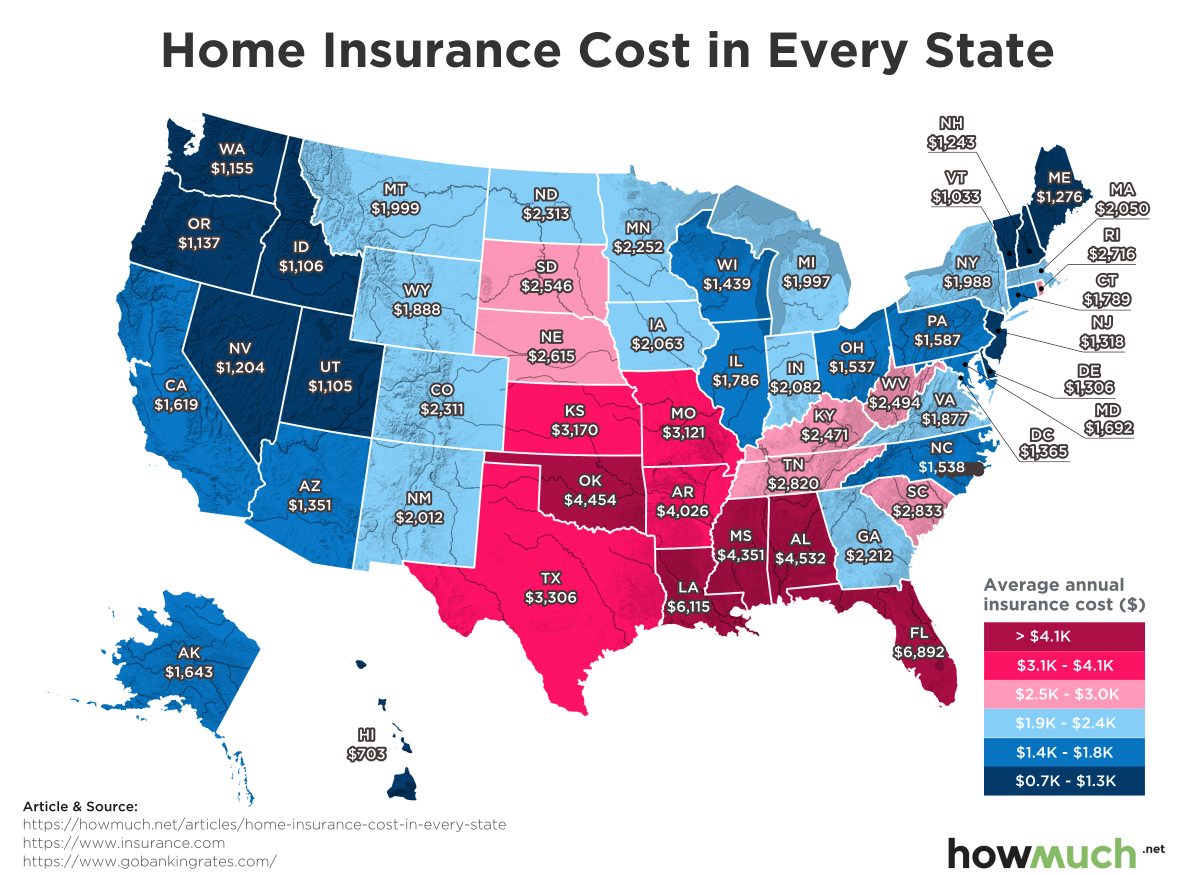

I guess what is happening is that a combination of pressures is slowly tightening the screws on inhabitants in these areas. This is squeezing out the less wealthy people who have lived in them, some for many years, in favor of people who can afford to rebuild from their own funds. Is this unfair? I know I'd think so if I lived there. But, at a safe distance, I can't think of any alternative other than forcing people to sell to some taxpayer-funded entity. That is happening now in the oft-flooded, interior, non-wealthy town of Manville, and it's causing fury. Inhabitants want the option of using the sum of money either for a buyout or for renovations, and they're being offered only a buyout.