aja8888

Moderator Emeritus

The above are percentage increases in inventory.

I would think it better to compare actual numbers of homes on the market compared to historical numbers. I would also like to how permits for new units are doing?

I suspect there is still a substantial shortage of affordable units In many areas.

For new housing:

https://wolfstreet.com/2022/08/23/s...gh-heaven-worst-since-peak-of-housing-bust-1/

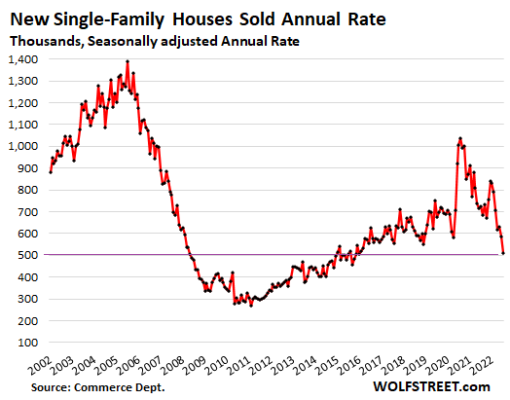

The plunge in home sales is just stunning. Sales of new single-family houses collapsed by 12.6% in July from the already beaten-down levels in June, and by nearly 30% from July last year, to a seasonally adjusted annual rate of 511,000 houses, the lowest since January 2016, and well below the lockdown lows, according to data from the Census Bureau today.

New house sales plunged in every region compared to July last year. Note the West, oh dear:

Northeast: -37%

West: -50%

Midwest: -23%

South: -21%.