dixonge

Thinks s/he gets paid by the post

If it is in any way, shape, form or fashion related to Agora then it's questionable.

SDR is Special Drawing Rights (a basket of world leading currencies) set by IMF in order to provide loans to International community in case of Financial crises or other temporary needs. Mr Rickards , so much criticized here, points out on our Fed Reserve Bank Balance sheet swollen to $4.5 trillions due to 2008 crises and following bail outs. Nobody denies that the Feds action helped to avoid a depression but if next Financial crises happen, the Feds cannot (in his view) to expand the balance sheet to $8 or $10 trillions as it may truly collapse the dollar). The IMF with their SDR could step in and bail out whatever crises may happen. Again, I am not sure how true all of it is but the IMF balance sheet is clear to act in case of similar to 2008 crises, therefor the SDR will be main reserve currency explains Mr Rickards. Portion of IMF assets are in physical Gold. That is as far as I understand it.I'm not 100% sure what an SDR is, so I'm guessing no, the USD will in fact remain important for a while.

I'm not 100% sure what an SDR is, so I'm guessing no, the USD will in fact remain important for a while.

Nobody denies that the Feds action helped to avoid a depression but if next Financial crises happen, the Feds cannot (in his view) to expand the balance sheet to $8 or $10 trillions as it may truly collapse the dollar). The IMF with their SDR could step in and bail out whatever crises may happen.

You statement is correct. However the main point here that China (2nd largest world economy which although slowing a lot lately still has much higher GDP growth rate 4.5 to 6% vs our 2 to 2.5%) started to trade with other countries in their own currencies, bypassing the dollar what reduces USD demand around the world. Then if Brazil (for example) needs a loan to import goods from S. Korea, Japan, China etc, they would go to IMF and take the SDR instead of many other needed currencies what is not even part of IMF currencies basket.So the Federal Reserve, backed by a $16T economy, can't expand it's balance sheet sufficiently to remedy whatever crisis we're imagining but the IMF, who gets about 15% of it's financing from the U.S., is somehow going to save the day with it's $750B lending capacity? And the currency they're going to use to bailout the collapsing US Dollar, the infamous SDR, derives 42% of its value from those very same U.S. dollars?

Call me skeptical.

You statement is correct. However the main point here that China (2nd largest world economy which although slowing a lot lately still has much higher GDP growth rate 4.5 to 6% vs our 2 to 2.5%) started to trade with other countries in their own currencies, bypassing the dollar what reduces USD demand around the world. Then if Brazil (for example) needs a loan to import goods from S. Korea, Japan, China etc, they would go to IMF and take the SDR instead of many other needed currencies what is not even part of IMF currencies basket.

MGI finds that the United States may not enjoy much of a privilege at all. In 2007–2008—a "normal" year for the world economy, the net financial benefit to the United States was between about $40 billion and $70 billion—or 0.3 to 0.5 percent of US GDP. In a "crisis" year—such as the year to June 2009—MGI estimates that the net financial benefit fell to between—$5 billion and $25 billion because the dollar appreciated by an additional 10 percent due its status as a "safe haven."

Famed promoter of financial tripe.If it is in any way, shape, form or fashion related to Agora then it's questionable.

Betting against the USD is the easiest way to make a million (by starting with a billion)!It will never happen. The USD is the safest and most sound currency in the world. And it will be for the foreseeable future.

YupSo, as Shakespeare might say, hand wringing about the role of the U.S. dollar reserve status is "much ado about nothing."

Came to the wrong place to stir up new followers...Some people are just no fun, letting facts get in the way of truthiness. How's a fella supposed to work up some righteous indignation in the face of this?

... Saying that I wonder if other ever read that book or just follow a popular opinion?

The Forum is a great place to discuss and/or ask for advise and guidance. Many discussions frequently have different opinions and advises. If we have majority opinion vs minority then you know what to follow. I am not a "promoter" or "the only truth" manipulator as some people here point out and fully aware of Agora Financials "influences on investments". However I did read the Currency Wars by Mr Rickards and it made sense to me. Saying that I wonder if other ever read that book or just follow a popular opinion?

I

So hopefully you think hard about the effects and results of "what if he is wrong" ?

I know, you are thinking, "sure BUT what if he is right?"

As I understood his recommendation, you would have 10 % or less of your assets in actual gold (not paper bonds) as a hedge against the concerns he outlines. So not catastrophic if he's wrong.

I personally have not chosen to have any precious metals in my assets. But recognize many others do as a hedge against their own concerns. So not sure how far off this guy is from many.

Sent from my iPhone using Early Retirement Forum

I run into this article and not sure how true it is in regard to consequences of USD replacement by the SDR. What do you think?

James Rickards: Secret 'Shanghai Accord' kills USD and crowns SDR TRUNEWS with Rick Wiles

James Rickards ... currently serves as the capital markets advisor to the Director of National Intelligence and the Office of the Secretary of Defense.

LOLOL - I wonder if they know he is making this claim...

For all the bashing this guy has gotten on this discussion thread, I'm surprised to see he's got enough acceptance to have made a presentation to a Senate Subcommittee.

Actually is interesting (especially in hindsight) , 13 page read discussing from 2012 perspective the government plan to drop interest rates to near zero and the impact on retirement savings.

Can agree or disagree with his conclusions/recommendations but I don't see the evidence to suggest he's a kook or that his ideas are unworthy of consideration.

Solutions are straightforward. The Fed should raise interest rates immediately by a modest amount of one-half of one percent and signal that other rate increases will be coming. The White House and Treasury should signal that they support the Fed’s move and support a strong dollar as well.

Rickards points out to business cycles (growth vs Recessions) what is always cyclical. The last recovery started in 2011 and soon (nobody knows when) we might be in recession cycle again. Then if Feds have near 0% interest rate now, how they are going to fight the recession? Of course there are negative rates (like in EU currently), helicopter money (something new what I do not understand) or another QE in Feds arsenal. Could it trigger an inflation higher than Feds projected 2%? That is his explanation.

The only worry here that inflation may go out of control while you are right that in times of recession and higher unemployment, it is usually deflation not inflation. However Rickards points out that there is still shadowy Gold standard going on in major Central Banks. US still keeps 8,130Tons of Gold, combined EU Gold vaults have over 10,000 Tons, China officially has 1,700 Tons but unofficially (if take a portion of China imported and produced Gold goes to PBOC) it is closer to 4,000Tons, Russia 1,415 Tons etc. If people / Banks are willing to pay good price for something well above jewelry demand, why Central Banks not selling it and some keep active purchases?Is the recession we're imagining deflationary? Because that is the typical recession profile (higher unemployment and weaker inflation).

So if we have a deflationary recession at a time when inflation is already below the Fed's 2% target, why are we worrying about above target inflation in this hypothetical scenario?

And is the suggestion to raise rates now, potentially causing a recession, so that the Fed has more room to lower rates to fight the recession it will likely have caused?

Perhaps you haven't noticed that a certain segment of our elected representatives support gold buggery.

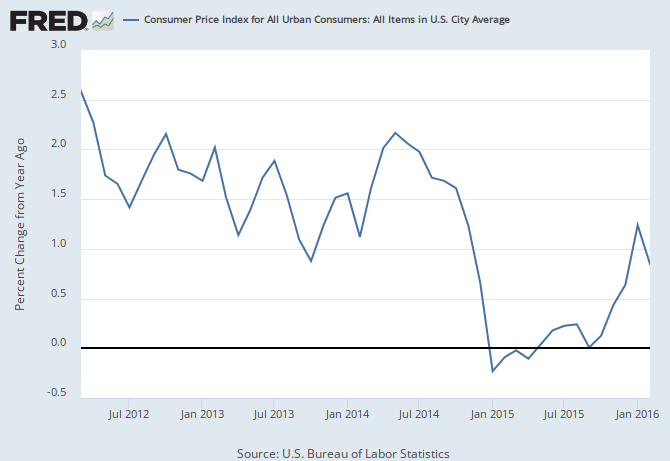

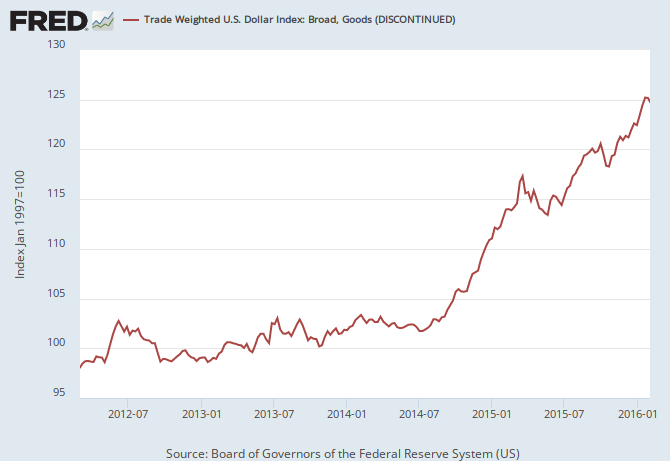

It is interesting that the style, tone, and substance of his Senate testimony bears zero resemblance to the article linked in the OP. Except that he does seem to have two different presentations for two different audiences. And now with the benefit of hindsight we can make some pronouncements about his more tempered recommendation before the Senate from four years ago:......The Fed and treasury didn't take Rickard's advice to raise rates and talk up the dollar in 2012. So what happened? Did inflation rise and the dollar fall? Nope.

Now we should stop to consider what would have happened had the Fed taken Rickard's advice and raised rates in 2012 and signaled much tighter monetary policy going forward. Would inflation have declined more and faster than it actually did? Would economic growth have undershot projections even more than it did? Both seem highly likely. More than that, it seems almost certain it would have pushed us into another recession.

Gee....a financial outlook that didn't pan out ....I am shocked.

The only worry here that inflation may go out of control while you are right that in times of recession and higher unemployment, it is usually deflation not inflation. However Rickards points out that there is still shadowy Gold standard going on in major Central Banks. US still keeps 8,130Tons of Gold, combined EU Gold vaults have over 10,000 Tons, China officially has 1,700 Tons but unofficially (if take a portion of China imported and produced Gold goes to PBOC) it is closer to 4,000Tons, Russia 1,415 Tons etc. If people / Banks are willing to pay good price for something well above jewelry demand, why Central Banks not selling it and some keep active purchases?