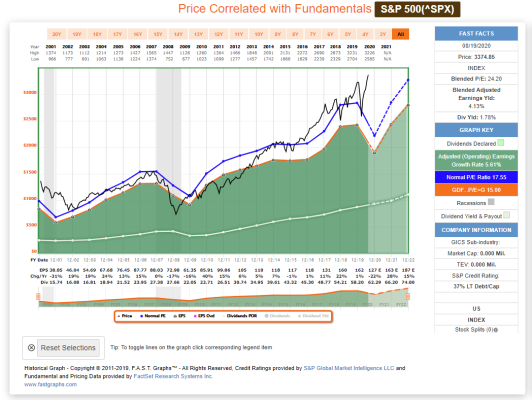

So when it comes to trying to understand today's market performance/valuations, what is it really taking into account...

- Recent/next quarter's/future projected performance?

- Talking heads?

- Financial data points (i.e. inflation, interest rates)?

- Current policy (i.e. current/projected tax policy, Fed policy)?

- Covid 19 vaccine timing?

- Election projections?

I like to play Monday morning QB and read the headlines and forecast the daily market performance and am frankly wrong many more times than I am right. Other than historical performance, I have given up making "this time it's different" decisions or "time to sell/market over valued" decisions in changing my financial strategy. I may test the different thinking out there, but so far have stayed the coarse. None the less, I get caught up in the chatter and scratch my head wondering... "should I do something THIS time?" The latest chatter getting my attention is the election. Many feel that if there is a change, new policy will cause the market to tank?? But, are the markets not efficient enough to have some of these probabilities already priced in? So, are the markets really valued right where they should be?

What say you?

- Recent/next quarter's/future projected performance?

- Talking heads?

- Financial data points (i.e. inflation, interest rates)?

- Current policy (i.e. current/projected tax policy, Fed policy)?

- Covid 19 vaccine timing?

- Election projections?

I like to play Monday morning QB and read the headlines and forecast the daily market performance and am frankly wrong many more times than I am right. Other than historical performance, I have given up making "this time it's different" decisions or "time to sell/market over valued" decisions in changing my financial strategy. I may test the different thinking out there, but so far have stayed the coarse. None the less, I get caught up in the chatter and scratch my head wondering... "should I do something THIS time?" The latest chatter getting my attention is the election. Many feel that if there is a change, new policy will cause the market to tank?? But, are the markets not efficient enough to have some of these probabilities already priced in? So, are the markets really valued right where they should be?

What say you?