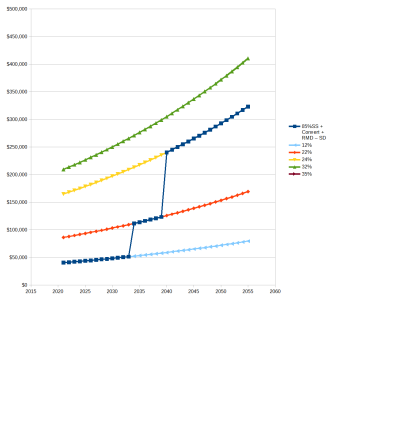

The goal is to move as much money as possible from my tIRA to my Roth. I am willing to move as much money as I can to get to the top of my tax bracket or perhaps the next. I am requesting feedback to double check that I am doing this with the best process to maximize the tax saving.

Background: Income consists of pension, deferred bonus, DW SS, capital gains, dividends and interest. There are no deductions opportunities except charitable. I have more short term losses than I have short or long term gains for this year.

Plan:

1. Open a Charitable Giving Account covering about a 3 year+ giving period funding it from a taxable account and focusing on large gain stocks. This will provide my only major deduction.

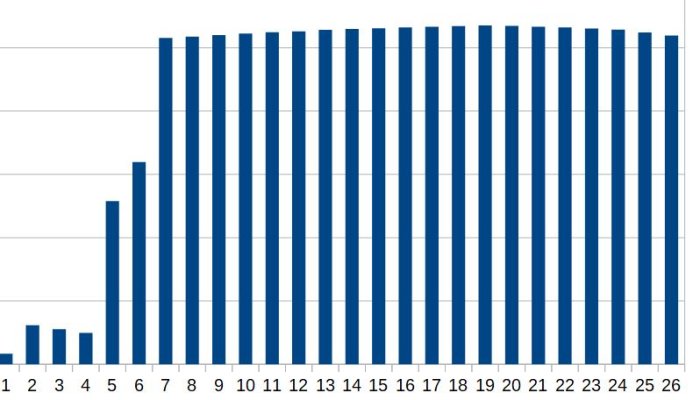

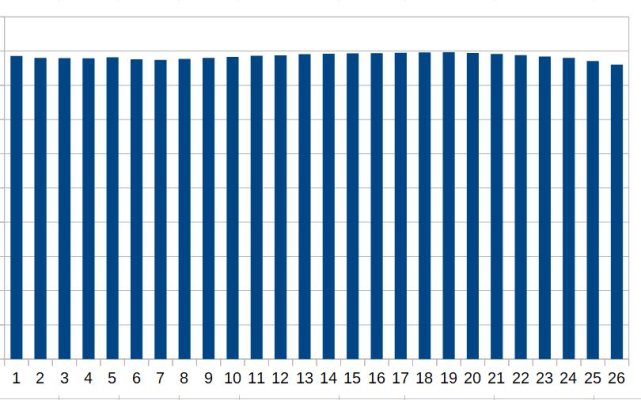

2. Move stocks (vs bonds) from my tIRA into the Roth. Although this may not matter in the short run, I am loading the tIRA with bonds to both slow the growth and keep the right profile in my taxable and Roth accounts.

3. Make sure I capture the $3,000 capital gains loss. (It is my understanding that is all I can capture. I do have more).

4. Pay Uncle Sam before the end of the year for the tIRA income based on my estimated taxes. I plan to do that with cash and not the tIRA or Roth.

Comments/thoughts/suggestions

Thanks

Background: Income consists of pension, deferred bonus, DW SS, capital gains, dividends and interest. There are no deductions opportunities except charitable. I have more short term losses than I have short or long term gains for this year.

Plan:

1. Open a Charitable Giving Account covering about a 3 year+ giving period funding it from a taxable account and focusing on large gain stocks. This will provide my only major deduction.

2. Move stocks (vs bonds) from my tIRA into the Roth. Although this may not matter in the short run, I am loading the tIRA with bonds to both slow the growth and keep the right profile in my taxable and Roth accounts.

3. Make sure I capture the $3,000 capital gains loss. (It is my understanding that is all I can capture. I do have more).

4. Pay Uncle Sam before the end of the year for the tIRA income based on my estimated taxes. I plan to do that with cash and not the tIRA or Roth.

Comments/thoughts/suggestions

Thanks