OverThinkMuch

Recycles dryer sheets

- Joined

- May 11, 2016

- Messages

- 313

After I paid for Rule Breakers, I went through every buy recommendation and entered them into a spreadsheet. Using their first buy recommendation and price, I calculated the gain and then the CAGR. Looking at the picks I entered into a spreadsheet, 88 beat the market (over 10.74%/year) and 31 underperformed. If you exclude stocks under a year old, that would be 85 beat and 24 underperformed. I was too lazy to research stocks that are no longer around, so I don't know the mix of acquired/collapsed stocks. That's an impressive ratio.

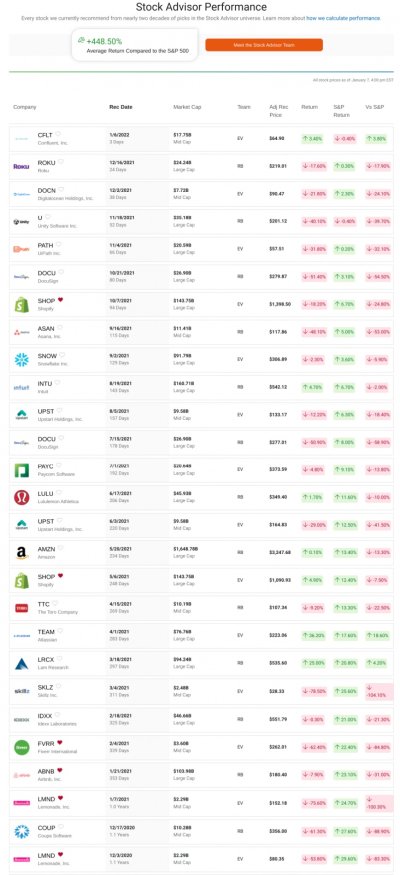

I see a public advertisement where Rule Breakers mentions a few stock picks and their performance from 2017-2020: Tesla +1320% and Shopify +4628% (VTI +82%). If you bought 24 stocks that went bankrupt, but also Shopify and Tesla, you beat the market. Now consider that the 24 multi-year losers had a median -3%/year performance, not bankruptcy. And that Tesla performance is extremely modest of them - Rule Breakers recommended Tesla long before 2017, and left out their +58% YTD performance. Tesla has done much better than +1320%, but they limited the time frame for comparison.

I see a public advertisement where Rule Breakers mentions a few stock picks and their performance from 2017-2020: Tesla +1320% and Shopify +4628% (VTI +82%). If you bought 24 stocks that went bankrupt, but also Shopify and Tesla, you beat the market. Now consider that the 24 multi-year losers had a median -3%/year performance, not bankruptcy. And that Tesla performance is extremely modest of them - Rule Breakers recommended Tesla long before 2017, and left out their +58% YTD performance. Tesla has done much better than +1320%, but they limited the time frame for comparison.

Last edited: