MichealKnight

Full time employment: Posting here.

- Joined

- May 2, 2019

- Messages

- 520

I'll use what I think is a mainstream fund for this question.

VWINX - Vanguard Wellsley

When owning a stock: Simple. You buy the shares, you get dividends and pay taxes on the dividends each year. You pay the capital gain - when you sell the stock.

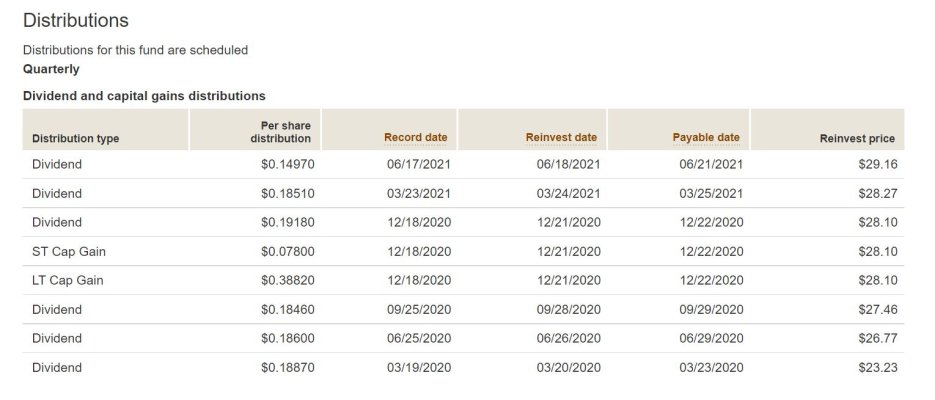

On a Mutual Fund..... VWINX for instance shows a 1.84%yield. Of course, you'd pay taxes on that 1.84% each year.

Question.... do you incur tax liability, every time VWINX sellls shares for a profit? OR do you only incur capital gains taxes when you actually sell the mutual fund at a higher price than you bought it? Thanks

VWINX - Vanguard Wellsley

When owning a stock: Simple. You buy the shares, you get dividends and pay taxes on the dividends each year. You pay the capital gain - when you sell the stock.

On a Mutual Fund..... VWINX for instance shows a 1.84%yield. Of course, you'd pay taxes on that 1.84% each year.

Question.... do you incur tax liability, every time VWINX sellls shares for a profit? OR do you only incur capital gains taxes when you actually sell the mutual fund at a higher price than you bought it? Thanks

). I usually forget about items 1 and 2 on your list because 99% of the time people just buy run-of-the-mill stocks and mutual funds that meet those criteria, so it generally boils down to the holding period.

). I usually forget about items 1 and 2 on your list because 99% of the time people just buy run-of-the-mill stocks and mutual funds that meet those criteria, so it generally boils down to the holding period.