Found this thread and thought it was most appropriate to ask my questions and make comments here because of the related topic. I too am looking at the Nationwide Peak 10 Fixed Index Annuity and here is why:

Here is a quick background and some relevant info:

58 year old male; spouse is 60 (both are trying to retire 1/1/2025)

Built up good savings in 99% qualified (401K) accounts

No pension; both plan to wait until 70 to maximize SS benefits

Planning to ages 91 and 94 for me and my wife

Considering very conservative returns (3%) on savings; not quite able to meet expenses

Savings draws down prior to end of plan.

This is how I am thinking about the annuity. I have heard all the arguments against them, and I certainly know I MAY be able to make more investing the money on my own, but consider this:

1) I need more guaranteed income, and even the minimum income guarantee from the rider provides that.

2) I don't want to count on the crazy stock market totally. I think that is bad for anyone unless you have tons of money.

3) I am talking about putting 25% of my portfolio in the annuity, 75% stays invested in 60/40 stocks bonds.

4) I don't really want to pay an advisor annual fees to manage my money buckets either, but may have to consider that.

5) Bad timing and sequence of returns is a real concern for me because I have to draw down that savings, and my expenses call for more than 4% withdraw each year.

6) I know my 3% return on savings is much less than what the market has done over periods of time, but I need to plan for worst case. If I can get that to look good, then everything else is gravy.

7) Sure, if I change the projected rate of savings to 5%, then it looks like I don't need the annuity and the plan works with just the savings. But can you really count on that?

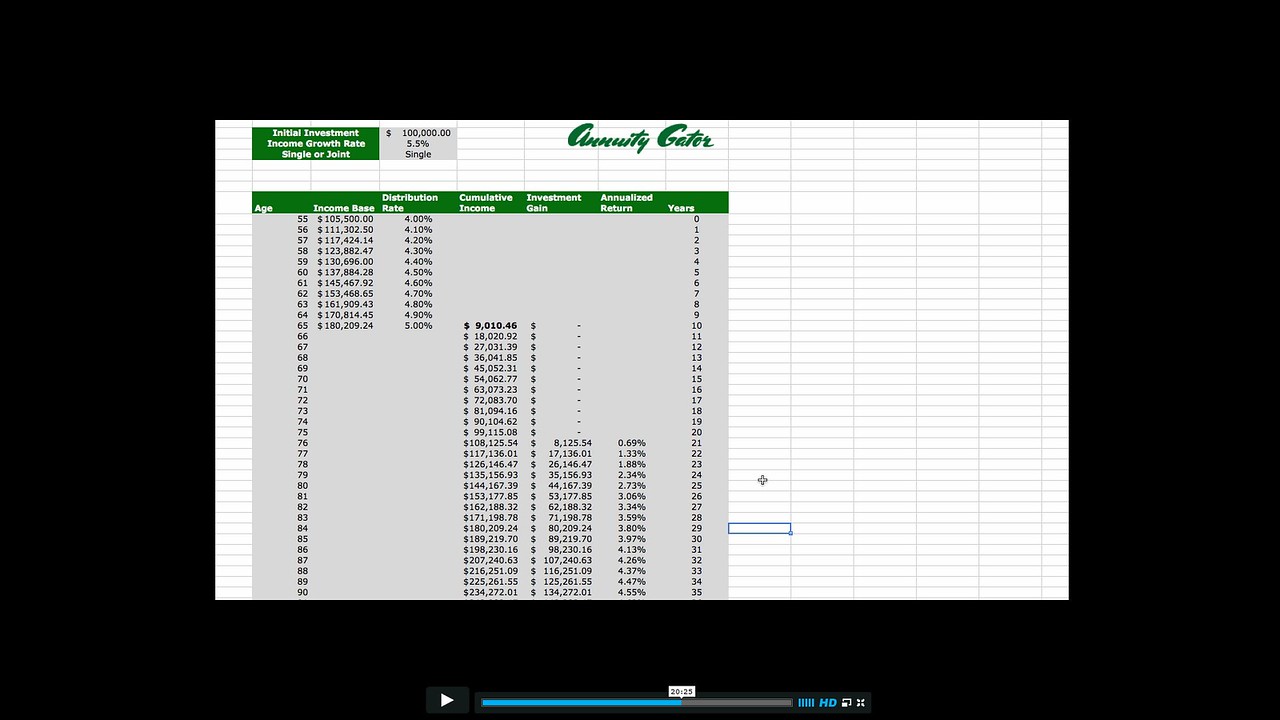

Investing 25% of my portfolio in the NW fixed index annuity gives me $87K annually starting at my age 65 for the rest of my life and my wife's. This $87K makes the plan work, especially with SS coming in at age 70, because it does not draw down the savings as fast, and in some cases does not draw it down at all. Yes, the $87K is level and not adjusted for inflation and is worth much less in 20 years, but again, it still makes the plan work.

So, tell me, why is this annuity so terrible for someone who needs it for income, considering what I have said above. If the minimum guarantee of $87K makes the plan work and it cannot go below that, why do I care about the contract value, fees, etc...

All this said, I am very concerned about going into this annuity. There are people much smarter than me and many are saying annuities are just terrible and stay away.