stephenson

Thinks s/he gets paid by the post

- Joined

- Jul 3, 2009

- Messages

- 1,610

Hi All,

UK friends are telling us they use Revolut vice debit or cash or credit cards when they travel to France and Spain.

Revolut has a good schtick wrt to best exchange rates, but it would still seem like a credit card with no foreign exchange fees would work well, but with perhaps a lesser exchange rste for Americans in those countries.

I’m getting a bit confused ... anyone else worked the math on this situation?

We usually use Chase Sapphire Reserve card. Good, usable points with a few other bennies.

Always willing to try something new ...

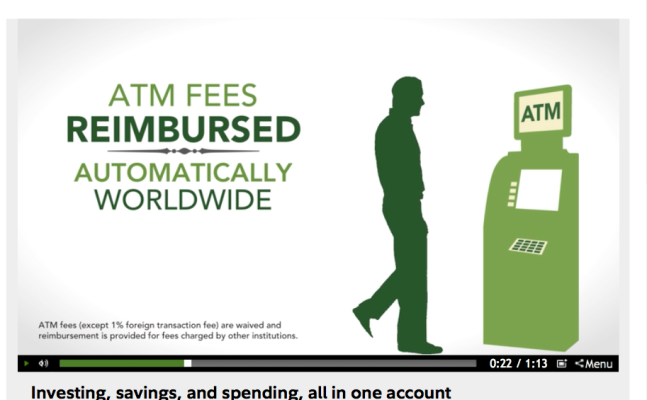

Here’s a related question ... I have a tour guide in Normandy who prefers Euros ... we all know why. How best to get Euros in France to do this? Paypal seems expensive, but not sure how expensive. ATMs will still end up charging, as well, but perhaps less?

Thanks!

UK friends are telling us they use Revolut vice debit or cash or credit cards when they travel to France and Spain.

Revolut has a good schtick wrt to best exchange rates, but it would still seem like a credit card with no foreign exchange fees would work well, but with perhaps a lesser exchange rste for Americans in those countries.

I’m getting a bit confused ... anyone else worked the math on this situation?

We usually use Chase Sapphire Reserve card. Good, usable points with a few other bennies.

Always willing to try something new ...

Here’s a related question ... I have a tour guide in Normandy who prefers Euros ... we all know why. How best to get Euros in France to do this? Paypal seems expensive, but not sure how expensive. ATMs will still end up charging, as well, but perhaps less?

Thanks!