REWahoo

Give me a museum and I'll fill it. (Picasso) Give

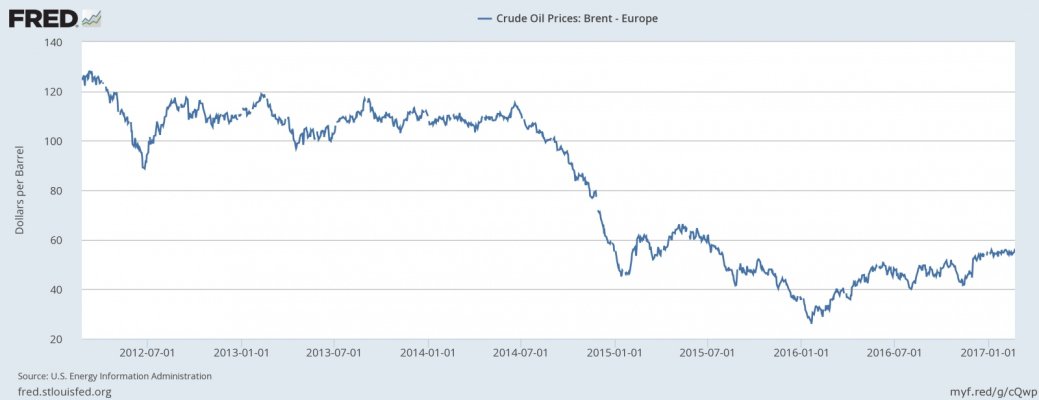

A current thread on hybrid cars reminded me of a "click bait" headline I saw a few days ago: Why oil prices will never return to $100 a barrel, in one chart

The bottom line of the article is...

So much for "peak oil" - at least for a generation or two.

The bottom line of the article is...

A persistent global glut of oil that has dogged markets for around two years may never truly subside, says one industry expert.

According to Spencer Dale, chief economist at oil giant BP, the global oil market suffers from an abundance of oil that’s going to add pressure on the industry for decades. ... BP estimates that there are about 2.5 trillion barrels of technically recoverable oil resources left in the world, enough to cover the world's entire oil demand out to 2050—twice.

So much for "peak oil" - at least for a generation or two.