You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Opinion of buying international equities now?

- Thread starter UpQuark

- Start date

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

International was a non correlated diversity play - years ago - not so much today.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

With the high dollar, it's possible there will be a boost in returns sometime over the next 15 years due to the US dollar dropping by up to 20%.

I do have a small amount of VXUS ,

I do have a small amount of VXUS ,

VanWinkle

Thinks s/he gets paid by the post

My crystal ball is cloudy at the moment, but I tax loss harvested mine into US total stock during Covid and have not returned to foreign stocks. As others here related, they have looked cheap for at least 10 years but the returns have been disappointing. I owned foreign equities for over 20 years.

VW

VW

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Of course, should Russia do something drastic, or just win the war conventionally. There is nothing to say they will stop, as there are a few other countries that were part of the Soviet bloc at various points in time.

This would mean a European war, which could hurt the Europena foreign stock market.

This would mean a European war, which could hurt the Europena foreign stock market.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is the time, when the dollar is so strong. But you might have to wait a long time. Who knows.

I maintain a smallish international position - 20% of equities.

I maintain a smallish international position - 20% of equities.

TripleLindy

Recycles dryer sheets

- Joined

- Aug 30, 2022

- Messages

- 296

International funds have been a drag on my returns for at least 5 years. I’m talking to my Vanguard advisor next week about reduction my position.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I always had some assets devoted to international my entire investment life and I can honestly say I do not ever remember them outperforming, but rather they consistently underperformed. I currently have 1% of my equities in international.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Made me look. Quicken says international is 6.8% of portfolio, 11% of the equity AA.

I used to have more, perhaps 20% of the equity AA in international. The poor performance was enough to hold back the entire portfolio, plus I did not have bonds when they did well. Had to work hard at picking US stocks, just to keep up with Wellington.

No, no more international. Ditto for emerging markets. Tired of waiting for them to emerge. Should have listened to the late Bogle, who said "you don't need international", back more than 10 years ago.

I used to have more, perhaps 20% of the equity AA in international. The poor performance was enough to hold back the entire portfolio, plus I did not have bonds when they did well. Had to work hard at picking US stocks, just to keep up with Wellington.

No, no more international. Ditto for emerging markets. Tired of waiting for them to emerge. Should have listened to the late Bogle, who said "you don't need international", back more than 10 years ago.

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I would not buy an international index. I prefer to look at individual names. It is a good time with strong dollar, but I prefer ti know exactly what I am buying as I believe the sectors matter.

My international allocation is quite small at present. 2-3 percent.

My international allocation is quite small at present. 2-3 percent.

foxcreek9

Recycles dryer sheets

- Joined

- Sep 19, 2015

- Messages

- 319

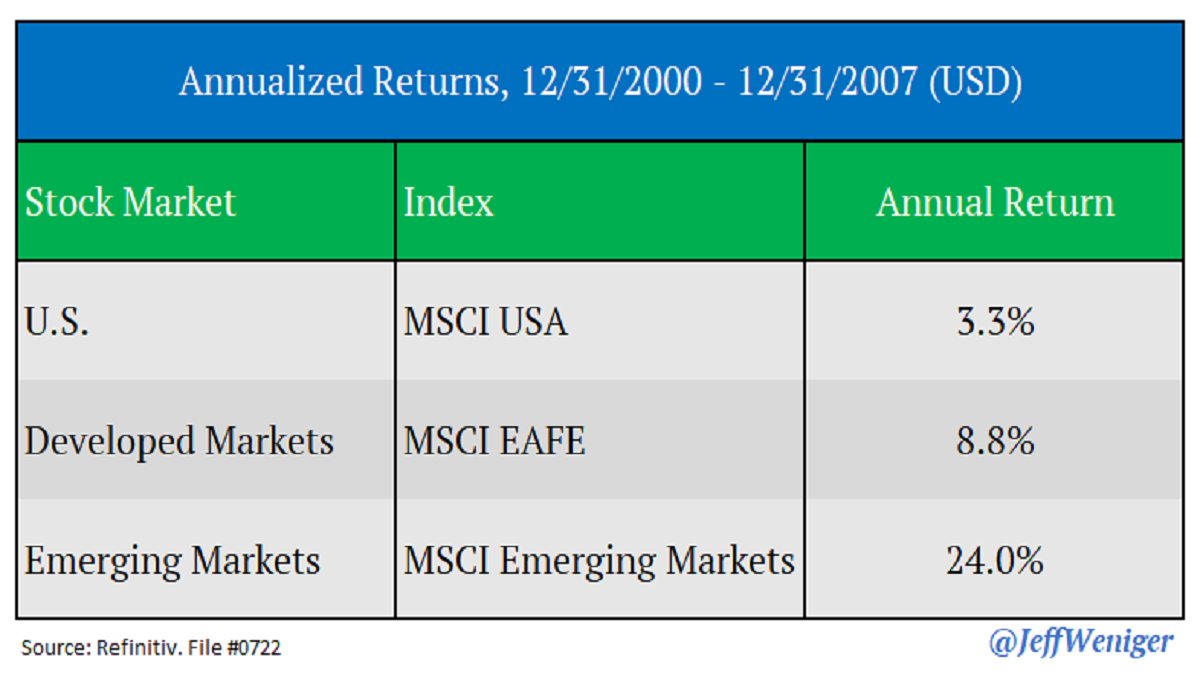

The last time the dollar was this strong and the years that followed

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Emerging market index used to be dominated by China stocks.

China economy is crumbling due to bad real estate investments, ghost cities, and lousy construction of high rises. The country has been alienated by the Western world due to its bellicose attitude towards other Asia countries.

With Xi Jinping tightening of his fists as demonstrated in the recent national assembly, some pundits have said that's the last nail in the coffin: China is no longer investable.

China economy is crumbling due to bad real estate investments, ghost cities, and lousy construction of high rises. The country has been alienated by the Western world due to its bellicose attitude towards other Asia countries.

With Xi Jinping tightening of his fists as demonstrated in the recent national assembly, some pundits have said that's the last nail in the coffin: China is no longer investable.

Out of Steam

Thinks s/he gets paid by the post

- Joined

- Mar 14, 2017

- Messages

- 1,669

With Xi Jinping tightening of his fists as demonstrated in the recent national assembly, some pundits have said that's the last nail in the coffin: China is no longer investable.

While I have expressed concern about excluding China from international index investing in the past, events of the past year or so suggest that "return of your money" is a real concern with any investment there.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Made me look. Quicken says international is 6.8% of portfolio, 11% of the equity AA.

I used to have more, perhaps 20% of the equity AA in international. The poor performance was enough to hold back the entire portfolio, plus I did not have bonds when they did well. Had to work hard at picking US stocks, just to keep up with Wellington.

No, no more international. Ditto for emerging markets. Tired of waiting for them to emerge. Should have listened to the late Bogle, who said "you don't need international", back more than 10 years ago.

+1 I used to have a significant slug of international equities as recommended by Vanguard. The returns were consistently underwhelming so I gave up on them.

enjoyinglife102

Recycles dryer sheets

- Joined

- Jan 6, 2013

- Messages

- 162

I imagine there are many smart people on this forum with lots saying you need them for better diversification. But given that Bogle declared "you don't need international stocks" and Buffet recommends to his heirs a stake in the S&P 500 index as their only equity position, that carries more weight to me. I don't own any and would have no intention to trade them based on valuation. A simpler portfolio is an added bonus.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As was mentioned large cap international is pretty well correlated with large cap US nowadays. So I focus on small cap international, specifically Vanguard International Explorer (VINEX). It only has 0.7% China but 5.5% Taiwan.

But I don't own VINEX now and haven't since May 2021. I trade on a monthly basis between SP500 and VINEX based on a measure of long term momentum. To be done in a tax deferred account. Probably will not interest anyone here but thought I'd mention it.

But I don't own VINEX now and haven't since May 2021. I trade on a monthly basis between SP500 and VINEX based on a measure of long term momentum. To be done in a tax deferred account. Probably will not interest anyone here but thought I'd mention it.

I have 17% of my portfolio in INTL equities and I've been unimpressed for several years. I own VTIAX, VXUS and VYMI (I'm aware there is overlap in those 3) and I'm going to reduce down to 5% or thereabouts. Just need to decide between putting the proceeds into VOO or VYM.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

EMXC is an ex-China emerging markets ETF.

International is about 30% of my equity allocation. I expect to bring it to 25% since new money’s going to U.S. funds.

+1 I used to have a significant slug of international equities as recommended by Vanguard. The returns were consistently underwhelming so I gave up on them.

I imagine there are many smart people on this forum with lots saying you need them for better diversification. But given that Bogle declared "you don't need international stocks" and Buffet recommends to his heirs a stake in the S&P 500 index as their only equity position, that carries more weight to me. I don't own any and would have no intention to trade them based on valuation. A simpler portfolio is an added bonus.

As was mentioned large cap international is pretty well correlated with large cap US nowadays. So I focus on small cap international, specifically Vanguard International Explorer (VINEX). It only has 0.7% China but 5.5% Taiwan.

But I don't own VINEX now and haven't since May 2021. I trade on a monthly basis between SP500 and VINEX based on a measure of long term momentum. To be done in a tax deferred account. Probably will not interest anyone here but thought I'd mention it.

I am not ready to give up totally on international, or even emerging markets. I don't know yet what I should get.

It is true that the US dollar cannot remain strong forever. But I may have to be more selective, e.g. be sure to exclude China. Russia, anyone?

friar1610

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2002

- Messages

- 1,639

This is the time, when the dollar is so strong. But you might have to wait a long time. Who knows.

I maintain a smallish international position - 20% of equities.

I’m in the same boat. Been tempted a few times recently to cash out my 22% international and put it in VTSAX. At 77 I might not have the longevity to wait for a turnaround.

Similar threads

- Replies

- 24

- Views

- 2K

- Replies

- 22

- Views

- 1K

- Replies

- 51

- Views

- 5K

- Replies

- 26

- Views

- 1K