SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just curious about something.

I mentally categorize my financial accounts, as I think most do, into my FIRE stash on the one hand and my day-to-day banking accounts on the other hand. In my case, the former includes my IRAs and a taxable account; the latter include checking, savings, and credit card accounts.

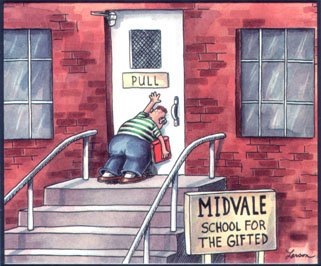

I use what I would call the "pull method": I spend down my cash on hand until it's almost out, then I pull some money from my FIRE stash to replenish it. In other words, I do my draws on an as-needed basis. I then monitor my WR to make sure I'm maintaining in a safe range.

It occurred to me that there could be another style, which I would call the "push method": Calculate a safe WR however you like, then use that to set up a regular draw to push money from FIRE to banking on a regular basis. In other words, do withdrawals regardless of one's banking account balances. In this approach, one would monitor safety simply by monitoring the level of cash in the banking accounts - if there's plenty of cash, then you're safe; if you're running dry then you're overspending your rate.

In my case, I've thought about the push method as maybe encouraging spending more, which might be a solution to my under-spending (I'm at a 1.17% net WR today), because the decision to pull money out at a certain rate would be automatic, rather than waiting until I am running low.

Which do you do? Pros, cons, thoughts?

I mentally categorize my financial accounts, as I think most do, into my FIRE stash on the one hand and my day-to-day banking accounts on the other hand. In my case, the former includes my IRAs and a taxable account; the latter include checking, savings, and credit card accounts.

I use what I would call the "pull method": I spend down my cash on hand until it's almost out, then I pull some money from my FIRE stash to replenish it. In other words, I do my draws on an as-needed basis. I then monitor my WR to make sure I'm maintaining in a safe range.

It occurred to me that there could be another style, which I would call the "push method": Calculate a safe WR however you like, then use that to set up a regular draw to push money from FIRE to banking on a regular basis. In other words, do withdrawals regardless of one's banking account balances. In this approach, one would monitor safety simply by monitoring the level of cash in the banking accounts - if there's plenty of cash, then you're safe; if you're running dry then you're overspending your rate.

In my case, I've thought about the push method as maybe encouraging spending more, which might be a solution to my under-spending (I'm at a 1.17% net WR today), because the decision to pull money out at a certain rate would be automatic, rather than waiting until I am running low.

Which do you do? Pros, cons, thoughts?