Some reading for those who haven't yet made up their mind.Sometimes they do, sometimes they don't.

Supply-Side Economics: The Concise Encyclopedia of Economics | Library of Economics and Liberty

Bottom line--the effects of tax cuts in enhancing government revenues are long-term rather than short-term, and more pronounced if marginal rates are higher.

Laffer and others note that government revenues increase with tax rate decreases only when the existing tax rates are in the right portion of the curve.

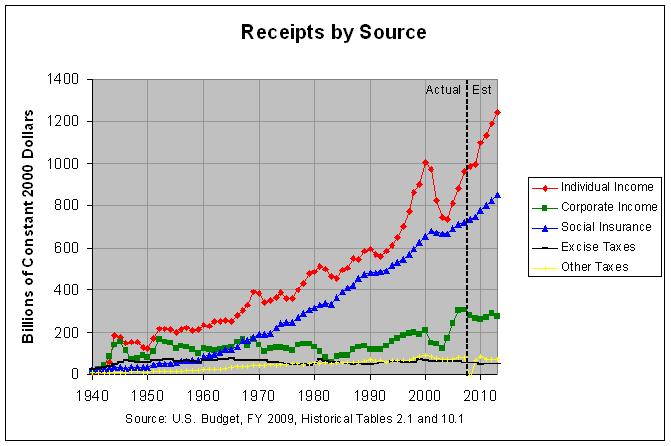

(Figure from Wikipedia)

Laffer curve: t** represents the rate of taxation at which maximal revenue is generated. Here the curve is symmetric for simplicity, which is not realistic.