Hello:

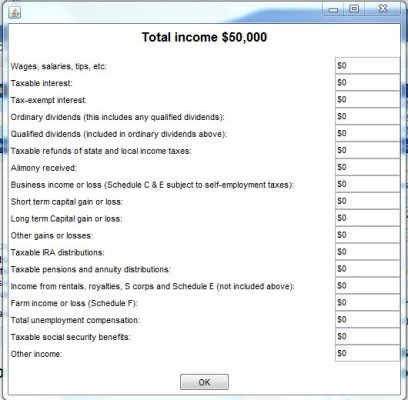

I am trying to estimate the amount of federal and state tax in my early retirement budget. I used an online calculator from H&R Block to do the federal tax estimate. I assumed that 15% of my retired early income would come from bond interest, 60% came from dividends and 25% would come from long term capital gains.

I ended up with 3.98% effective federal tax rate and a 2.92% effective state tax rate (I used New Jersey as the residence state). If these estimates are a good approximation of my federal and state tax liability during early retirement, I can then add these tax numbers to my cost of living budget to obtain an accurate estimate of my annual cost when I retire early.

Based on your experience in early retirement, or your own planning for a future early retirement, do these effective federal and state tax percentage estimates sound about right to you?

Thank you for your advice.

I am trying to estimate the amount of federal and state tax in my early retirement budget. I used an online calculator from H&R Block to do the federal tax estimate. I assumed that 15% of my retired early income would come from bond interest, 60% came from dividends and 25% would come from long term capital gains.

I ended up with 3.98% effective federal tax rate and a 2.92% effective state tax rate (I used New Jersey as the residence state). If these estimates are a good approximation of my federal and state tax liability during early retirement, I can then add these tax numbers to my cost of living budget to obtain an accurate estimate of my annual cost when I retire early.

Based on your experience in early retirement, or your own planning for a future early retirement, do these effective federal and state tax percentage estimates sound about right to you?

Thank you for your advice.