But it follows, as night follows day, that lots of active managers must underperform the indexes. How are we to know in advance which are which?

Ummm...that's what the title of this thread is about. There would be no point in researching funds if it were futile. My earlier posts on this subject explain my thinking on why I think ARK Invest funds focusing on disruptive technologies will out-perform over the next decade or two.

In case it wasn't clear, I think the most popular index for buyers of index funds, the S&P 500, has a lot of companies that will be negatively impacted by the disruption that is coming. Now, more than ever, it's important to be in funds that consider the way the world is changing rapidly based on these disruptive technologies. Sure, some of the biggest beneficiaries are already in the S&P 500 but many are too small or not yet profitable enough to be included. These are the companies that will have out-sized growth and take business away from established players.

I must say I was very confused in your earlier posts about indexes underperforming expecations. Is that just a strawman? What "expectations" are you referring to? Are you somehow implying that actively managed funds will outperform "expectations"?

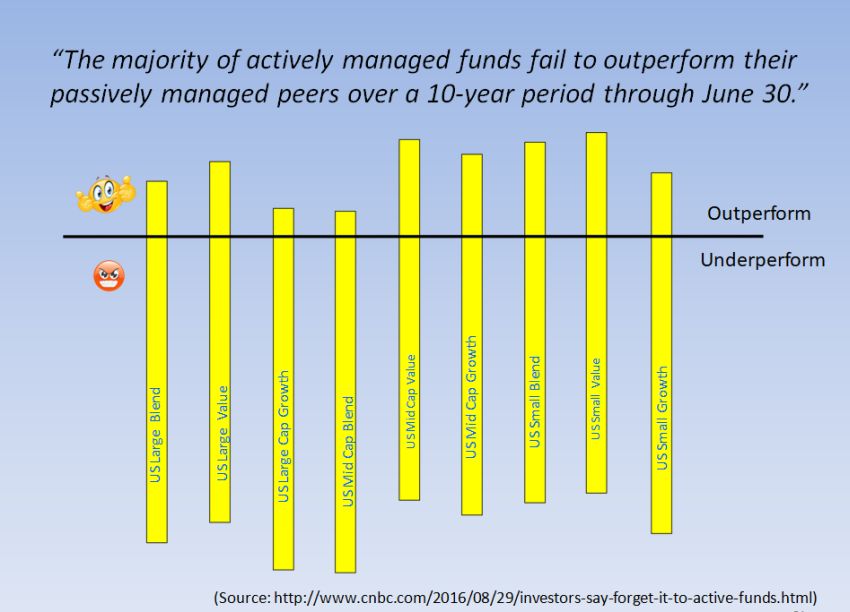

I continue to believe many or most actively managed funds will underperform the S&P 500 Index because they are managed by financial types with MBA's who don't understand the disruptive technologies that will be hitting the market in a big way over the next decade.

A fund family like ARK Invest specializes in these disruptive technologies and has analysts with expertise in each and every one of the disruptive technologies they cover. These analysts actually visit many of these small companies that are doing the ground-breaking research that will lead to big business opportunities. These specialized analysts can actually understand, for example, the science going on behind the genomics companies and appraise it in terms of whether it's almost ready for prime time. They are familiar with how costs of gene sequencing are dropping and a myriad of other details around the science so they can better analyze risks and potential profits.

To an analyst with an MBA but not any science background, this research just looks like mumbo jumbo. Since they can't make heads or tails of it, they can't buy a company like this until the product hits the market and starts generating revenue and profits. So, ARK gets in before the MBA types realize how much the technology is worth and start bidding the price up. That's what will provide the out-sized returns.

It's actual a travesty that brokerages and funds use MBA types that don't have a clue. And we wonder why the typical actively managed fund performs so poorly? Sure, some of it is due to expenses but it just makes common sense to have actual experts in the subject matter appraise it for risks, rewards and when it will be ready for prime time in the market. An MBA can't hope to do that without understanding the basics behind the technology.

Are you claiming that TSLA was not in the Total Market index? The S&P 500 is a sector index of large-cap funds. It is a large fraction of the total market, but please don't equate "S&P 500" with "major indexes."

Nope. I must have misspoke. But the S&P 500 is the most widely used benchmark in the US and has a long history of regularly out-performing the total market index.