Out of Steam

Thinks s/he gets paid by the post

- Joined

- Mar 14, 2017

- Messages

- 1,669

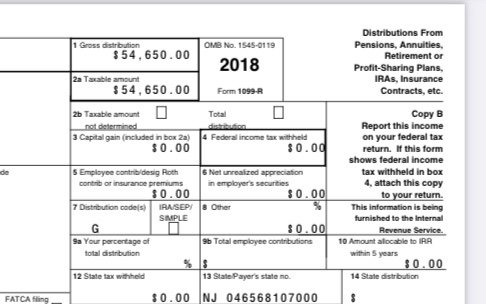

My daughter rolled over a small (pretax) 401(k) account from a previous employer, but transferred it to a Roth IRA as it was the only IRA she had, rather than a pretax IRA.

Since the amount was small, she was willing to pay the taxes on it. But the tax program she is working with (Taxslayer) says that this was improper and she has to pay a penalty for early withdrawal as well as the taxes.

I had advised her that this was OK and both she and my wife are rather unhappy with me. My wife is recommending she get a financial advisor.

Is this true? Is there any way to fix it other than paying the penalty?

Since the amount was small, she was willing to pay the taxes on it. But the tax program she is working with (Taxslayer) says that this was improper and she has to pay a penalty for early withdrawal as well as the taxes.

I had advised her that this was OK and both she and my wife are rather unhappy with me. My wife is recommending she get a financial advisor.

Is this true? Is there any way to fix it other than paying the penalty?

Last edited: