My investments are all in VTI due to low costs and diversification.

I’m talking to family and friends it seems maybe 1 out of 20 people in my group follow a similar strategy. Most don’t invest at all, buy through a financial manager, invest in real estate, buy whole life insurance or buy individual stocks. I was assuming that almost everyone was simply buying VTI or similar., but that doesn’t seem to be the case.

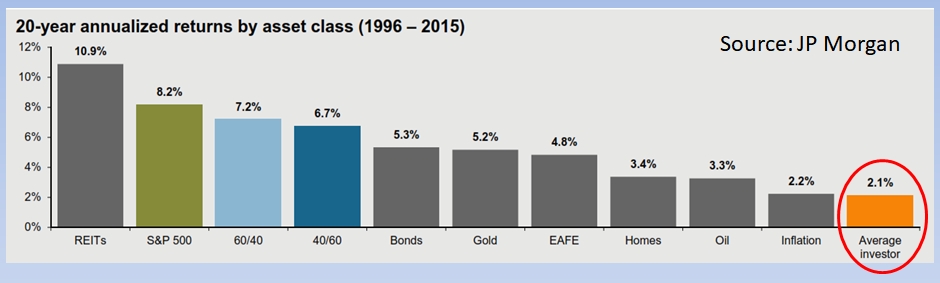

Has anyone run across numbers for how much the typical investor is underperforming the S&P 500 once you take into consideration excessive fund fees and poor asset allocation?

Thanks

I’m talking to family and friends it seems maybe 1 out of 20 people in my group follow a similar strategy. Most don’t invest at all, buy through a financial manager, invest in real estate, buy whole life insurance or buy individual stocks. I was assuming that almost everyone was simply buying VTI or similar., but that doesn’t seem to be the case.

Has anyone run across numbers for how much the typical investor is underperforming the S&P 500 once you take into consideration excessive fund fees and poor asset allocation?

Thanks