Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not suggesting this is best or only, but FWIW. He does this annually.

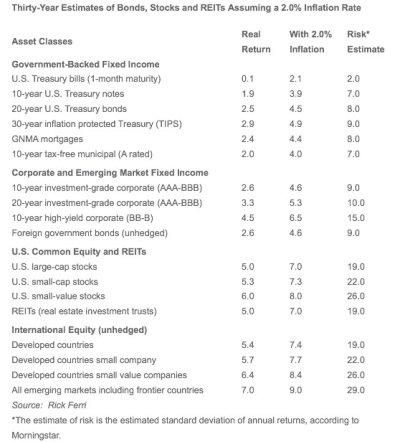

Portfolio Solutions’ 30-Year Market Forecast for Investment Planning (2014 Edition)

Portfolio Solutions’ 30-Year Market Forecast for Investment Planning (2014 Edition)