Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

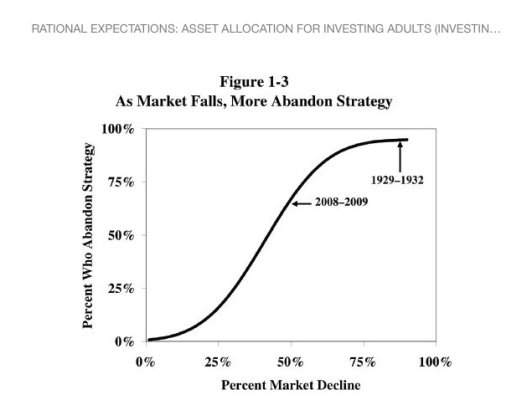

In the midst of reading Bernstein's Rational Expectations and found this graph interesting. He doesn't disclose where his numbers come from (that I could see), but his conceptual read on the relationship between investors who fully understand their risk tolerance vs market drops, and those who "cave" on the way down. Everyone thinks they understand their personal risk tolerance, until they don't...

Note it's independent of AA, maybe suggesting even investors with lower equity allocations may bail when the going gets rough(er than normal).

It's well documented that he was surprised, even shocked by the behavior of his own presumably sophisticated well-to-do clients during the 2008-09 meltdown. Here that is quantified?

Note it's independent of AA, maybe suggesting even investors with lower equity allocations may bail when the going gets rough(er than normal).

It's well documented that he was surprised, even shocked by the behavior of his own presumably sophisticated well-to-do clients during the 2008-09 meltdown. Here that is quantified?

Attachments

Last edited:

).

).